Shareholders of Dycom would probably like to forget the past six months even happened. The stock dropped 21.1% and now trades at $151.58. This might have investors contemplating their next move.

Following the pullback, is now an opportune time to buy DY? Find out in our full research report, it’s free.

Why Does DY Stock Spark Debate?

Working alongside some of the most popular mobile carriers in the world, Dycom (NYSE: DY) builds and maintains telecommunications infrastructure.

Two Positive Attributes:

1. Skyrocketing Revenue Shows Strong Momentum

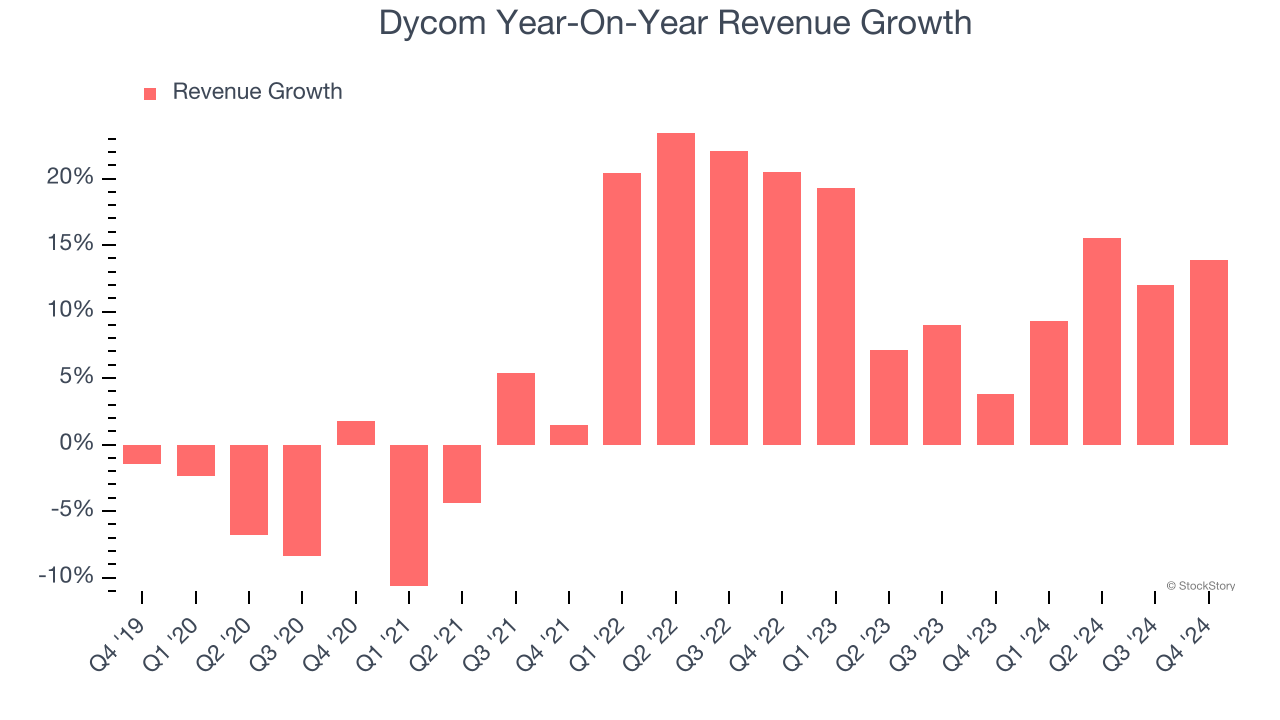

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Dycom’s annualized revenue growth of 11.1% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

2. Outstanding Long-Term EPS Growth

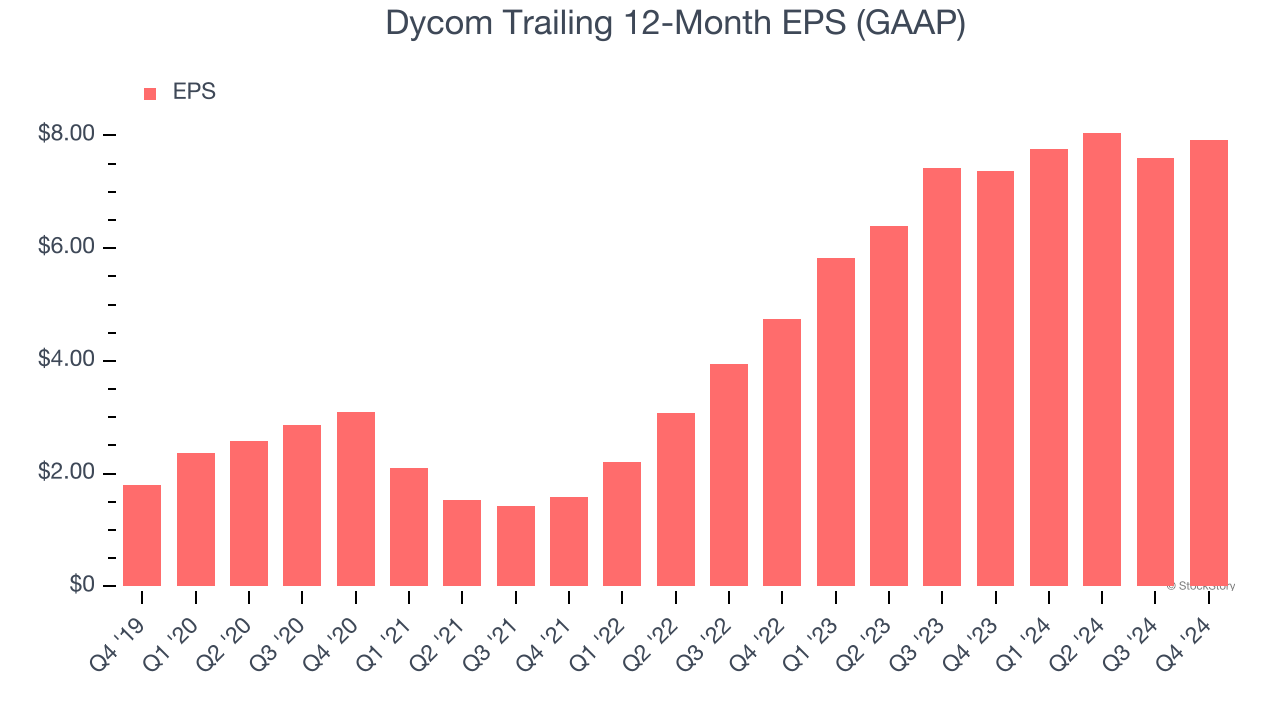

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Dycom’s EPS grew at an astounding 34.5% compounded annual growth rate over the last five years, higher than its 7.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

Free Cash Flow Margin Dropping

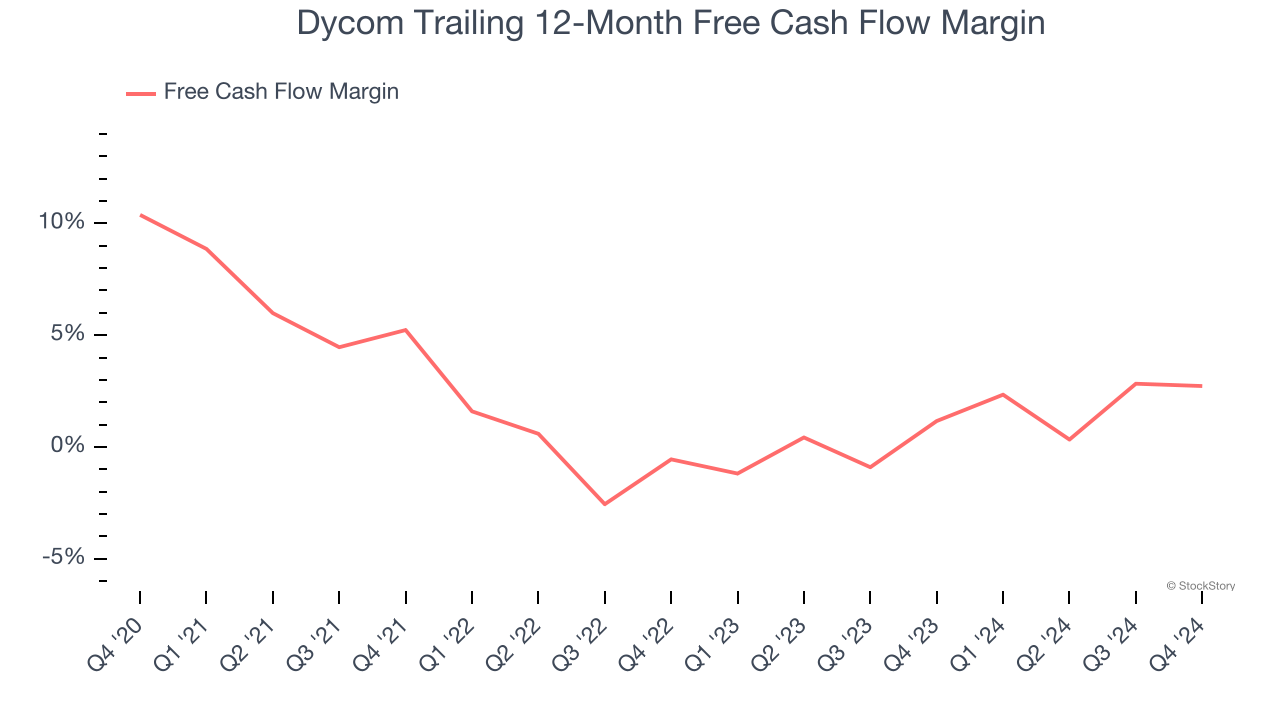

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Dycom’s margin dropped by 7.7 percentage points over the last five years. If the trend continues, it could signal it’s in the middle of a big investment cycle. Dycom’s free cash flow margin for the trailing 12 months was 2.7%.

Final Judgment

Dycom’s positive characteristics outweigh the negatives. After the recent drawdown, the stock trades at 16.1× forward price-to-earnings (or $151.58 per share). Is now the right time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Dycom

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.