In a sliding market, Warby Parker has defied the odds, trading up to $18.07 per share. Its 16% gain since October 2024 has outpaced the S&P 500’s 1.6% drop. This performance may have investors wondering how to approach the situation.

Is it too late to buy WRBY? Find out in our full research report, it’s free.

Why Does WRBY Stock Spark Debate?

Founded in 2010, Warby Parker (NYSE: WRBY) designs, manufactures, and sells eyewear, including prescription glasses, sunglasses, and contact lenses, through its e-commerce platform and physical retail locations.

Two Things to Like:

1. New Stores Opening at Breakneck Speed

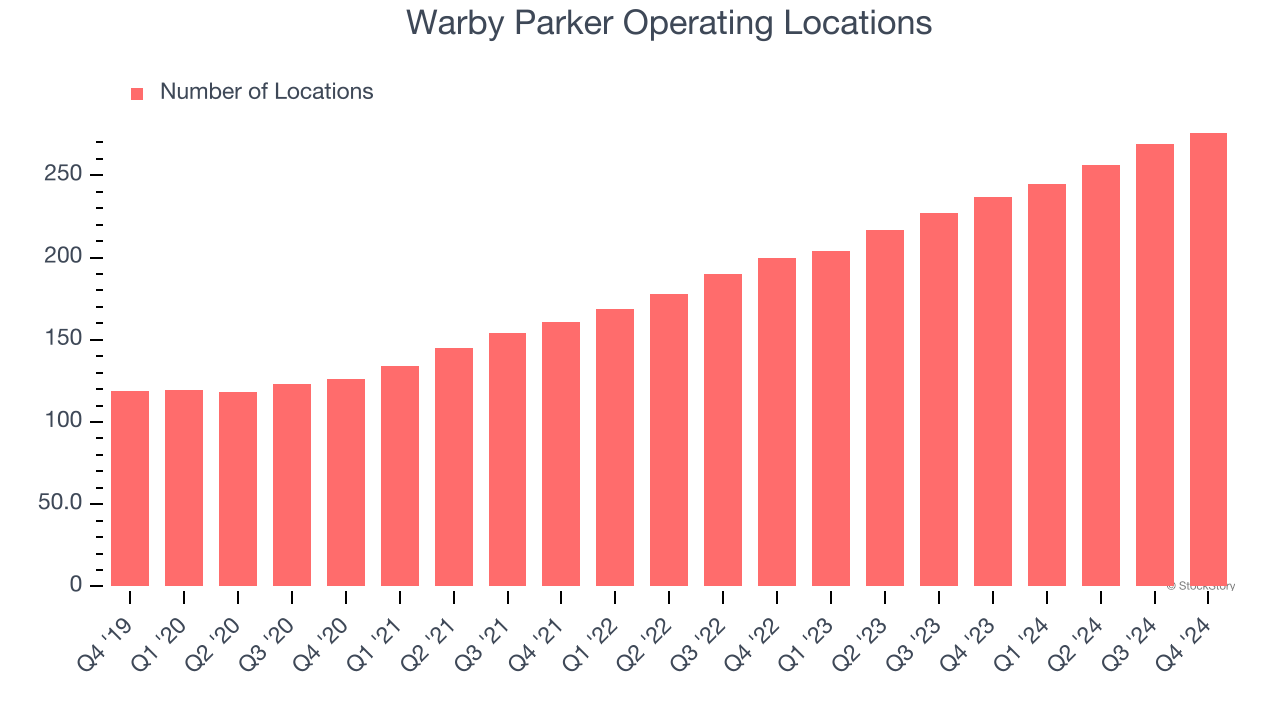

A retailer’s store count often determines how much revenue it can generate.

Warby Parker operated 276 locations in the latest quarter. It has opened new stores at a rapid clip over the last two years, averaging 19.2% annual growth, much faster than the broader consumer retail sector. This gives it a chance to scale into a mid-sized business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

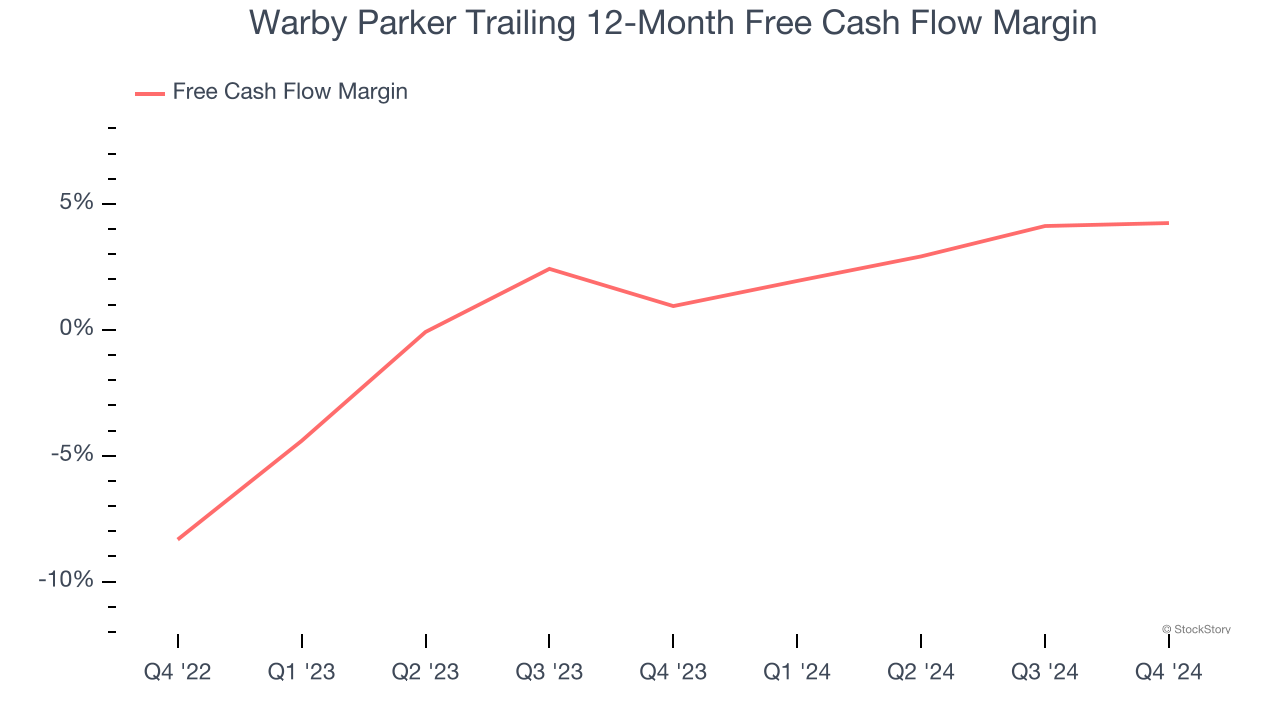

2. Increasing Free Cash Flow Margin Juices Financials

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Warby Parker’s margin expanded by 3.3 percentage points over the last year. This is encouraging because it gives the company more optionality. Warby Parker’s free cash flow margin for the trailing 12 months was 4.2%.

One Reason to be Careful:

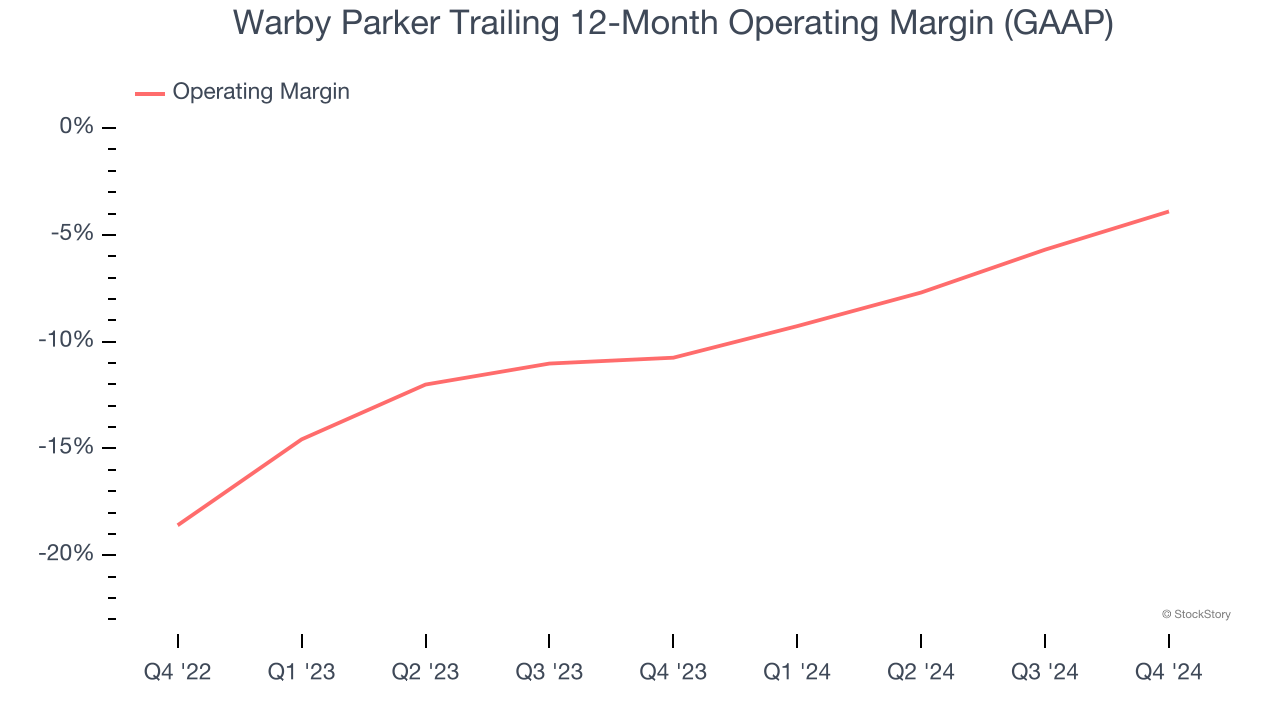

Operating Losses Sound the Alarms

Operating margin is a key profitability metric because it accounts for all expenses necessary to run a store, including wages, inventory, rent, advertising, and other administrative costs.

Despite the consumer retail industry’s secular decline, unprofitable public companies are few and far between. Unfortunately, Warby Parker was one of them over the last two years as its high expenses contributed to an average operating margin of negative 7.1%.

Final Judgment

Warby Parker’s merits more than compensate for its flaws, and with its shares outperforming the market lately, the stock trades at 53.4× forward price-to-earnings (or $18.07 per share). Is now a good time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Warby Parker

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.