Looking back on online marketplace stocks’ Q4 earnings, we examine this quarter’s best and worst performers, including ACV Auctions (NYSE: ACVA) and its peers.

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

The 13 online marketplace stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 2.1% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 15.4% since the latest earnings results.

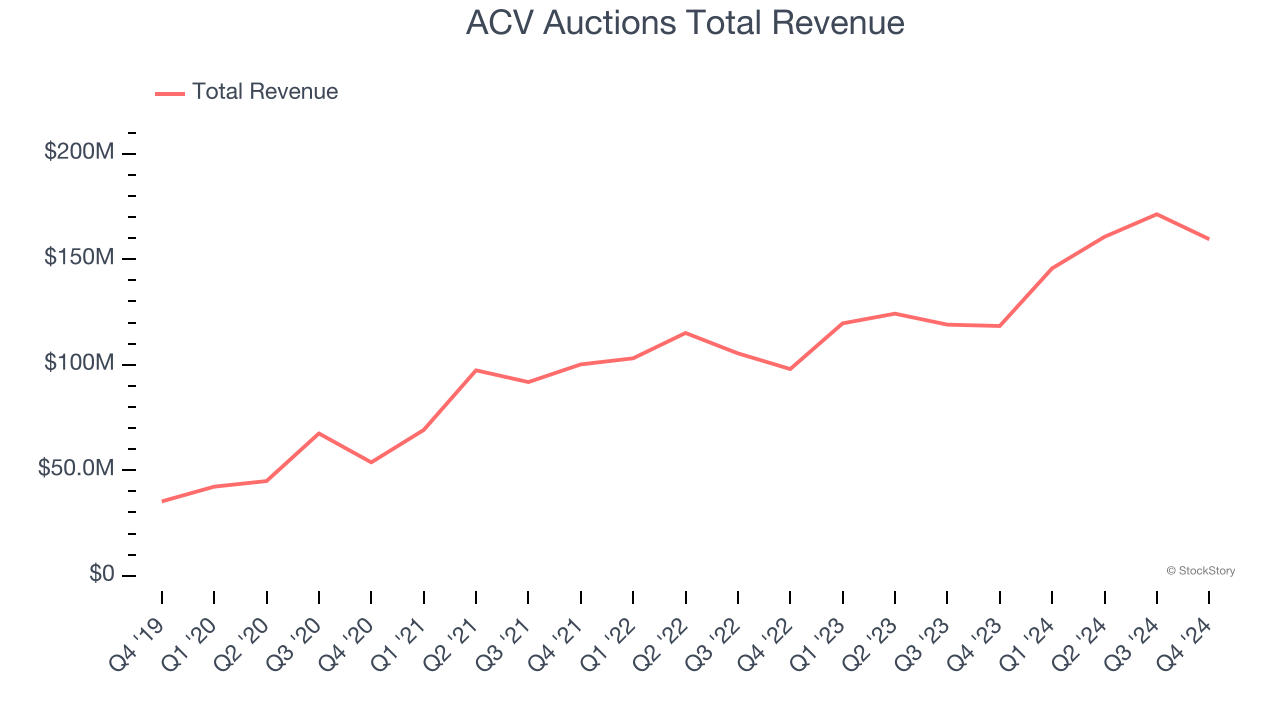

ACV Auctions (NYSE: ACVA)

Founded in 2014, ACV Auctions (NASDAQ: ACVA) is an online auction marketplace for car dealers and wholesalers to buy and sell used cars.

ACV Auctions reported revenues of $159.5 million, up 34.8% year on year. This print exceeded analysts’ expectations by 2.4%. Despite the top-line beat, it was still a slower quarter for the company with full-year EBITDA guidance missing analysts’ expectations.

“We are very pleased with our fourth quarter results, with revenue and Adjusted EBITDA above the high-end of our guidance range, along with continued margin expansion. ACV's leading market position resulted in additional share gains and strong revenue growth in the quarter. Our expanding suite of dealer solutions gained further market traction and we executed on initiatives to support our commercial wholesale strategy,” said George Chamoun, CEO of ACV.

ACV Auctions delivered the weakest full-year guidance update of the whole group. The company reported 183,497 units sold, up 27.4% year on year. Unsurprisingly, the stock is down 32.4% since reporting and currently trades at $13.93.

Is now the time to buy ACV Auctions? Access our full analysis of the earnings results here, it’s free.

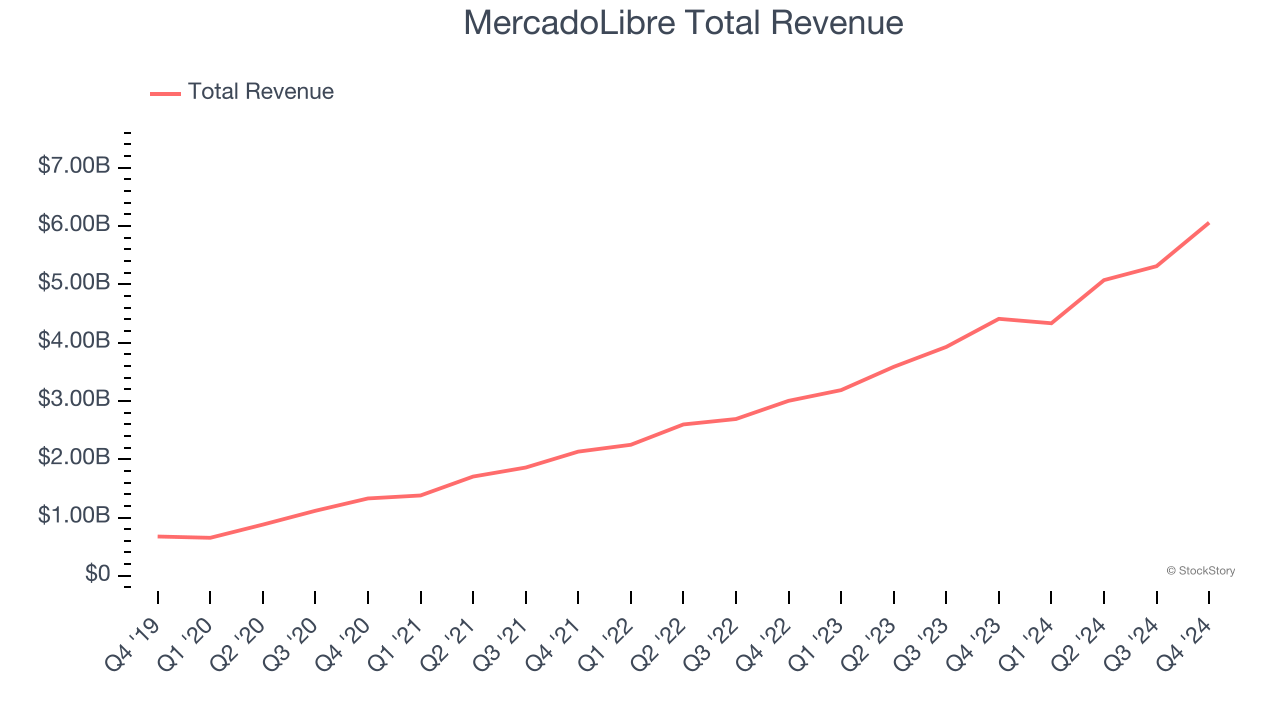

Best Q4: MercadoLibre (NASDAQ: MELI)

Originally started as an online auction platform, MercadoLibre (NASDAQ: MELI) is a one-stop e-commerce marketplace and fintech platform in Latin America.

MercadoLibre reported revenues of $6.06 billion, up 37.4% year on year, outperforming analysts’ expectations by 2.8%. The business had an exceptional quarter with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ number of unique active users estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 7.2% since reporting. It currently trades at $1,966.

Is now the time to buy MercadoLibre? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Teladoc (NYSE: TDOC)

Founded to help people in rural areas get online medical consultations, Teladoc Health (NYSE: TDOC) is a telemedicine platform that facilitates remote doctor’s visits.

Teladoc reported revenues of $640.5 million, down 3% year on year, in line with analysts’ expectations. It was a softer quarter as it posted full-year EBITDA guidance missing analysts’ expectations.

Teladoc delivered the slowest revenue growth in the group. The company reported 93.8 million users, up 4.7% year on year. As expected, the stock is down 27.6% since the results and currently trades at $7.96.

Read our full analysis of Teladoc’s results here.

Etsy (NASDAQ: ETSY)

Founded by a struggling amateur furniture maker Robert Kalin and his two friends, Etsy (NASDAQ: ETSY) is one of the world’s largest online marketplaces, focusing on handmade or vintage items.

Etsy reported revenues of $852.2 million, up 1.2% year on year. This number missed analysts’ expectations by 1.2%. Overall, it was a softer quarter as it also logged a slight miss of analysts’ number of active buyers estimates and a decline in its buyers.

The company reported 95.46 million active buyers, down 1.1% year on year. The stock is down 17.7% since reporting and currently trades at $47.19.

Read our full, actionable report on Etsy here, it’s free.

eHealth (NASDAQ: EHTH)

Aiming to address a high-stakes and often confusing decision, eHealth (NASDAQ: EHTH) guides consumers through health insurance enrollment and related topics.

eHealth reported revenues of $315.2 million, up 27.3% year on year. This result beat analysts’ expectations by 11.4%. Overall, it was a very strong quarter as it also put up a solid beat of analysts’ EBITDA estimates and full-year EBITDA guidance exceeding analysts’ expectations.

eHealth delivered the biggest analyst estimates beat among its peers. The stock is down 30% since reporting and currently trades at $6.41.

Read our full, actionable report on eHealth here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.