Collegium Pharmaceutical’s stock price has taken a beating over the past six months, shedding 31.6% of its value and falling to $26.01 per share. This might have investors contemplating their next move.

Following the drawdown, is now an opportune time to buy COLL? Find out in our full research report, it’s free.

Why Does Collegium Pharmaceutical Spark Debate?

Pioneering abuse-deterrent technology in a field plagued by addiction concerns, Collegium Pharmaceutical (NASDAQ: COLL) develops and markets specialty medications for treating moderate to severe pain, including abuse-deterrent opioid formulations.

Two Positive Attributes:

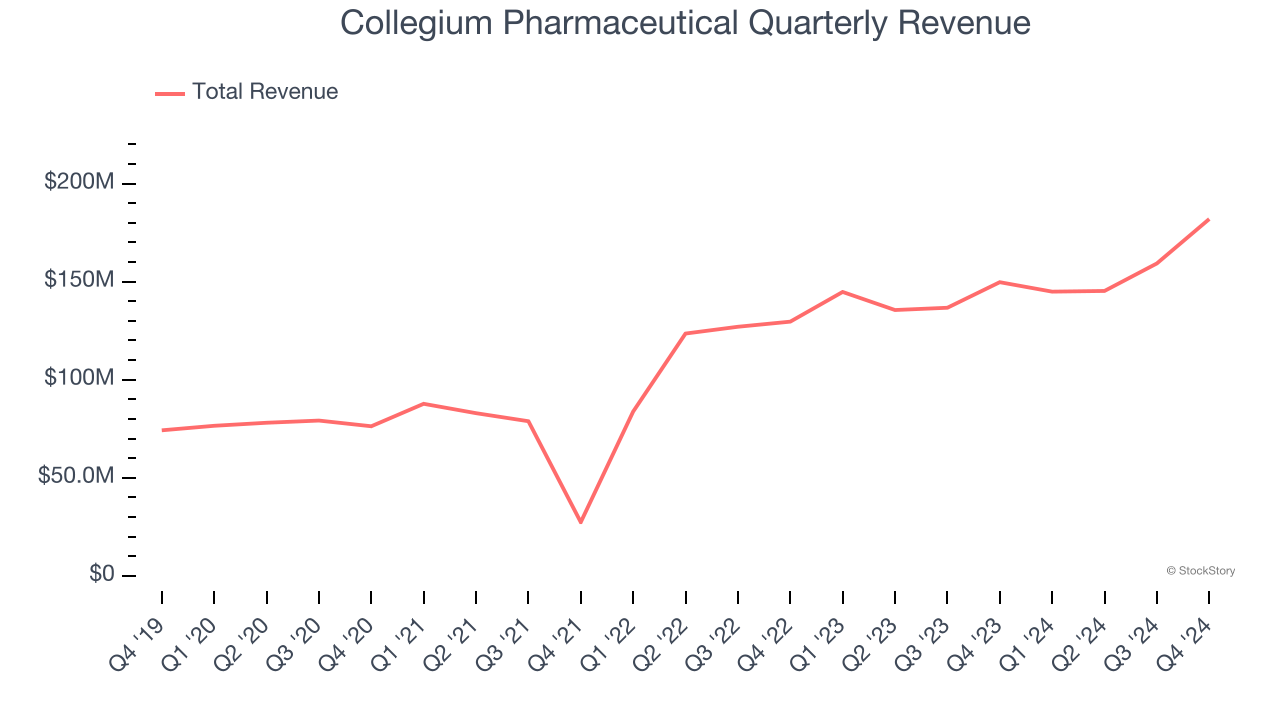

1. Long-Term Revenue Growth Shows Strong Momentum

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Collegium Pharmaceutical’s sales grew at a solid 16.3% compounded annual growth rate over the last five years. Its growth surpassed the average healthcare company and shows its offerings resonate with customers.

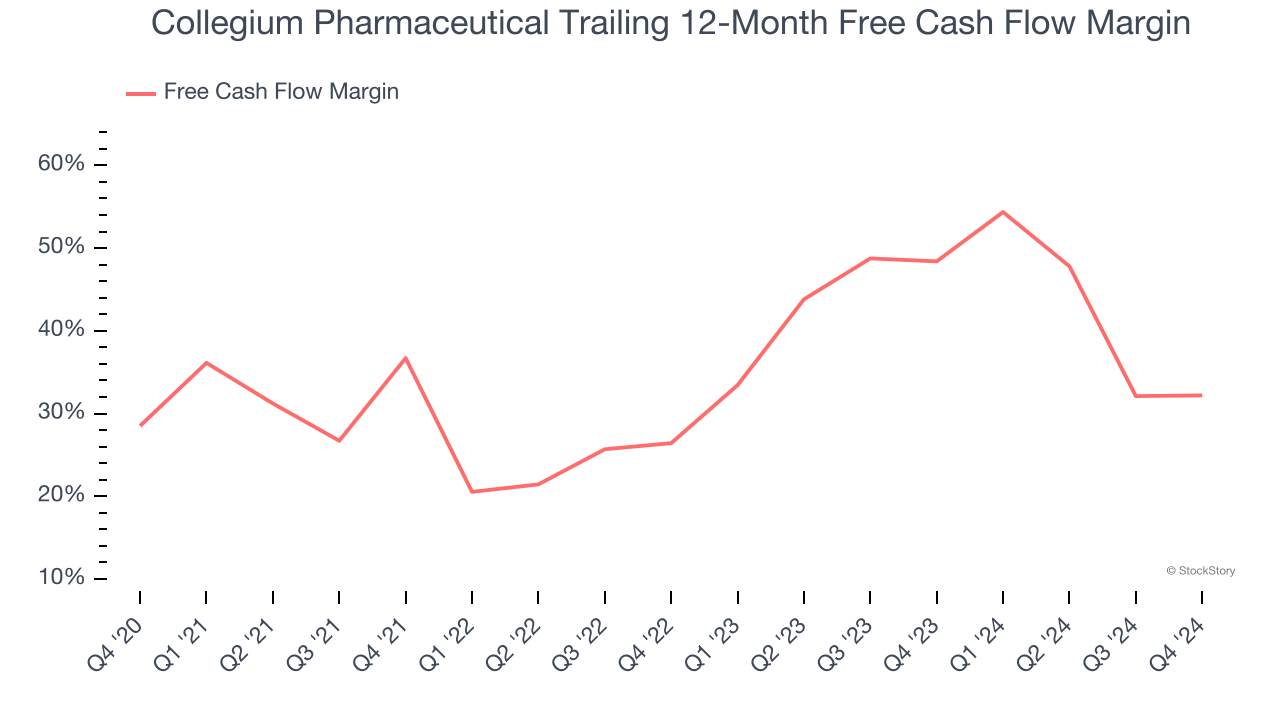

2. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Collegium Pharmaceutical has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the healthcare sector, averaging an eye-popping 35.1% over the last five years.

One Reason to be Careful:

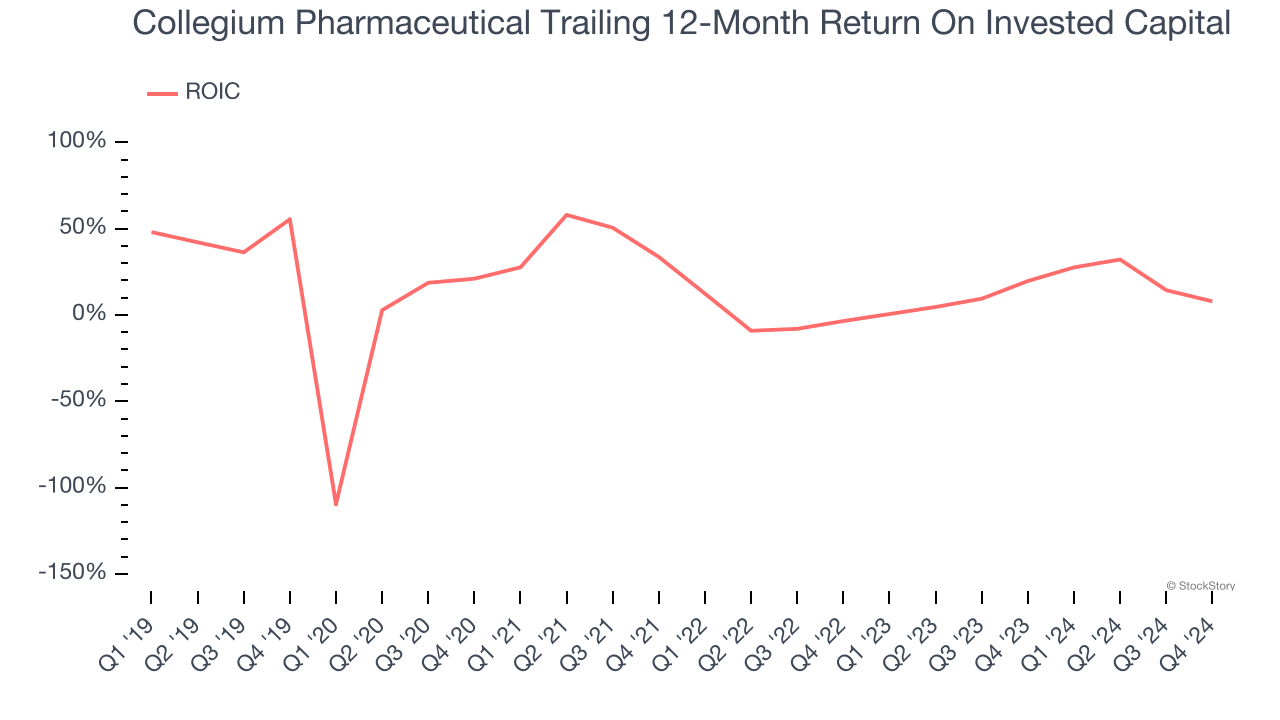

New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Collegium Pharmaceutical’s ROIC has unfortunately decreased significantly. Only time will tell if its new bets can bear fruit and potentially reverse the trend.

Final Judgment

Collegium Pharmaceutical’s positive characteristics outweigh the negatives. With the recent decline, the stock trades at 4.1× forward price-to-earnings (or $26.01 per share). Is now the right time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Collegium Pharmaceutical

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.