What a brutal six months it’s been for Denny's. The stock has dropped 52.8% and now trades at $2.99, rattling many shareholders. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Denny's, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Even with the cheaper entry price, we're sitting this one out for now. Here are three reasons why DENN doesn't excite us and a stock we'd rather own.

Why Do We Think Denny's Will Underperform?

Open around the clock, Denny’s (NASDAQ: DENN) is a chain of diner restaurants serving breakfast and traditional American fare.

1. Restaurants Are Closing, a Headwind for Revenue

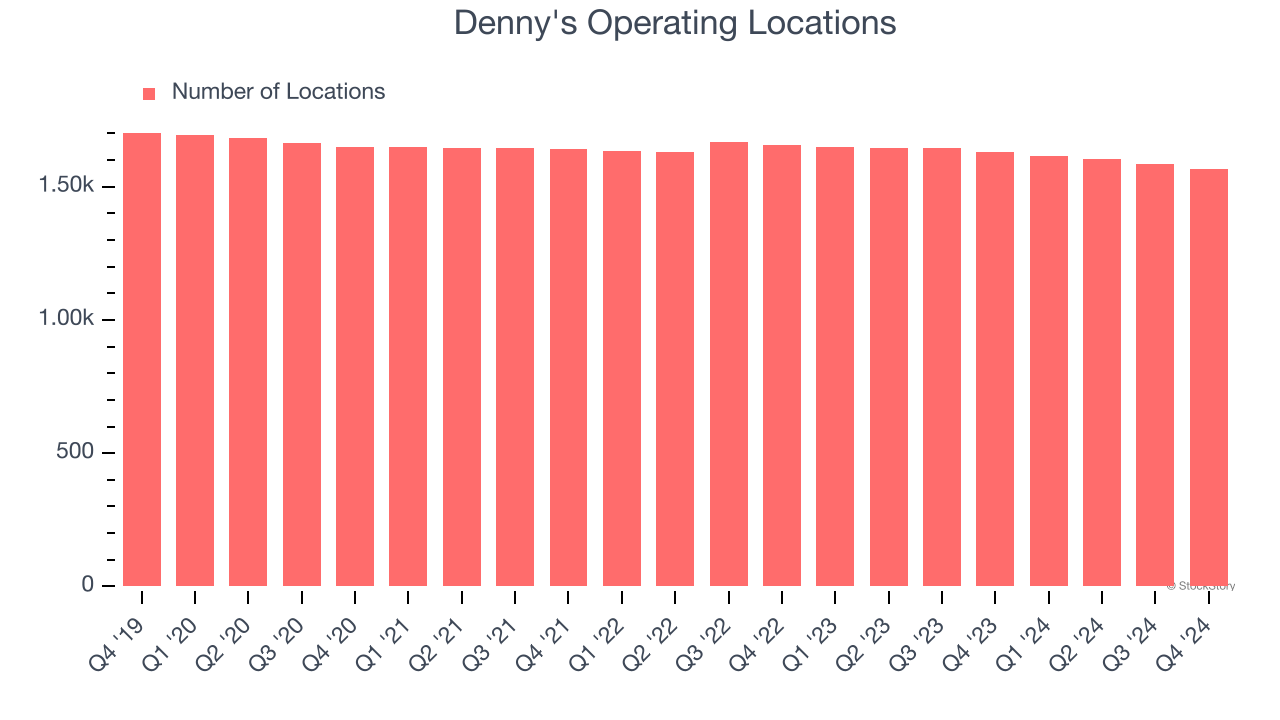

A restaurant chain’s total number of dining locations often determines how much revenue it can generate.

Denny's operated 1,568 locations in the latest quarter. Over the last two years, the company has generally closed its restaurants, averaging 1.6% annual declines.

When a chain shutters restaurants, it usually means demand for its meals is waning, and it is responding by closing underperforming locations to improve profitability.

2. Fewer Distribution Channels Limit its Ceiling

With $452.3 million in revenue over the past 12 months, Denny's is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

3. Free Cash Flow Margin Dropping

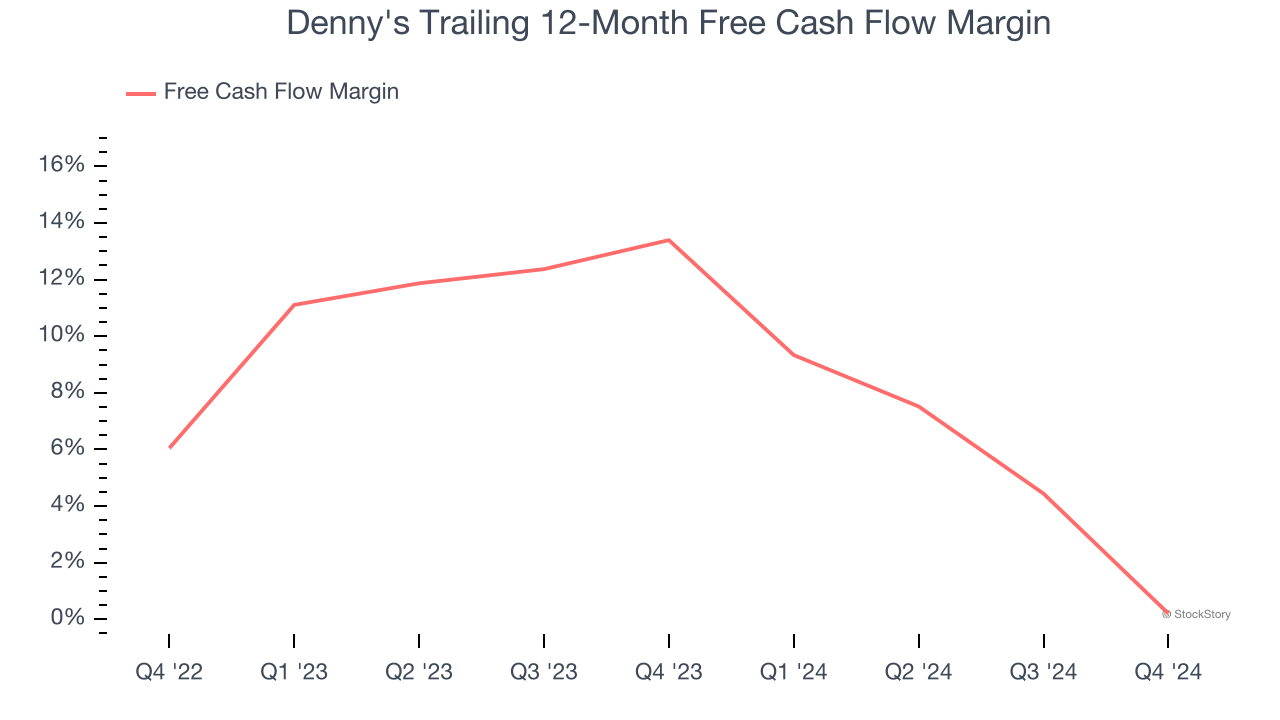

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Denny’s margin dropped by 13.2 percentage points over the last year. If its declines continue, it could signal increasing investment needs and capital intensity. Denny’s free cash flow margin for the trailing 12 months was breakeven.

Final Judgment

Denny's falls short of our quality standards. After the recent drawdown, the stock trades at 5.2× forward price-to-earnings (or $2.99 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are more exciting stocks to buy at the moment. We’d recommend looking at the Amazon and PayPal of Latin America.

Stocks We Like More Than Denny's

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.