While the broader market has struggled with the S&P 500 down 7.3% since October 2024, DocuSign has surged ahead as its stock price has climbed by 9.4% to $75.30 per share. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now the time to buy DocuSign, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

We’re happy investors have made money, but we're swiping left on DocuSign for now. Here are three reasons why you should be careful with DOCU and a stock we'd rather own.

Why Is DocuSign Not Exciting?

Founded by Seattle-based entrepreneur Tom Gonser, DocuSign (NASDAQ: DOCU) is the pioneer of e-signature and offers software as a service that allows people and organisations to sign legally binding documents electronically.

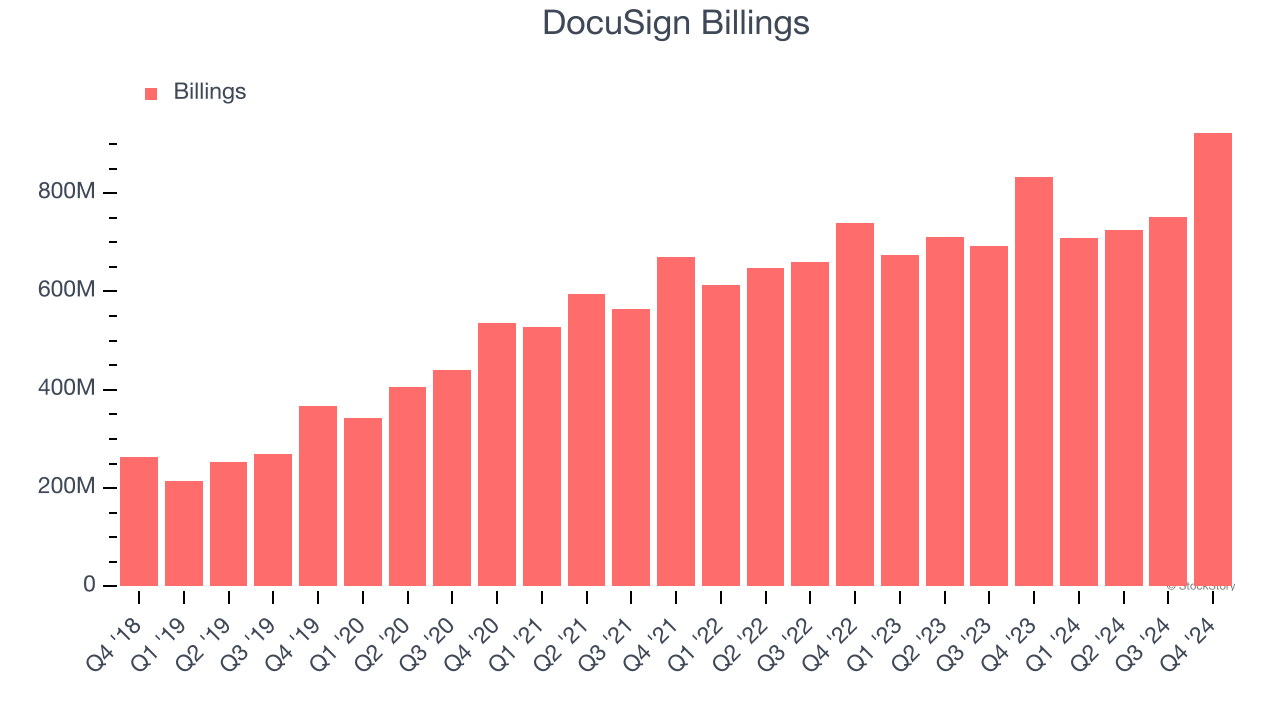

1. Weak Billings Point to Soft Demand

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

DocuSign’s billings came in at $923.2 million in Q4, and over the last four quarters, its year-on-year growth averaged 6.6%. This performance was underwhelming and suggests that increasing competition is causing challenges in acquiring/retaining customers.

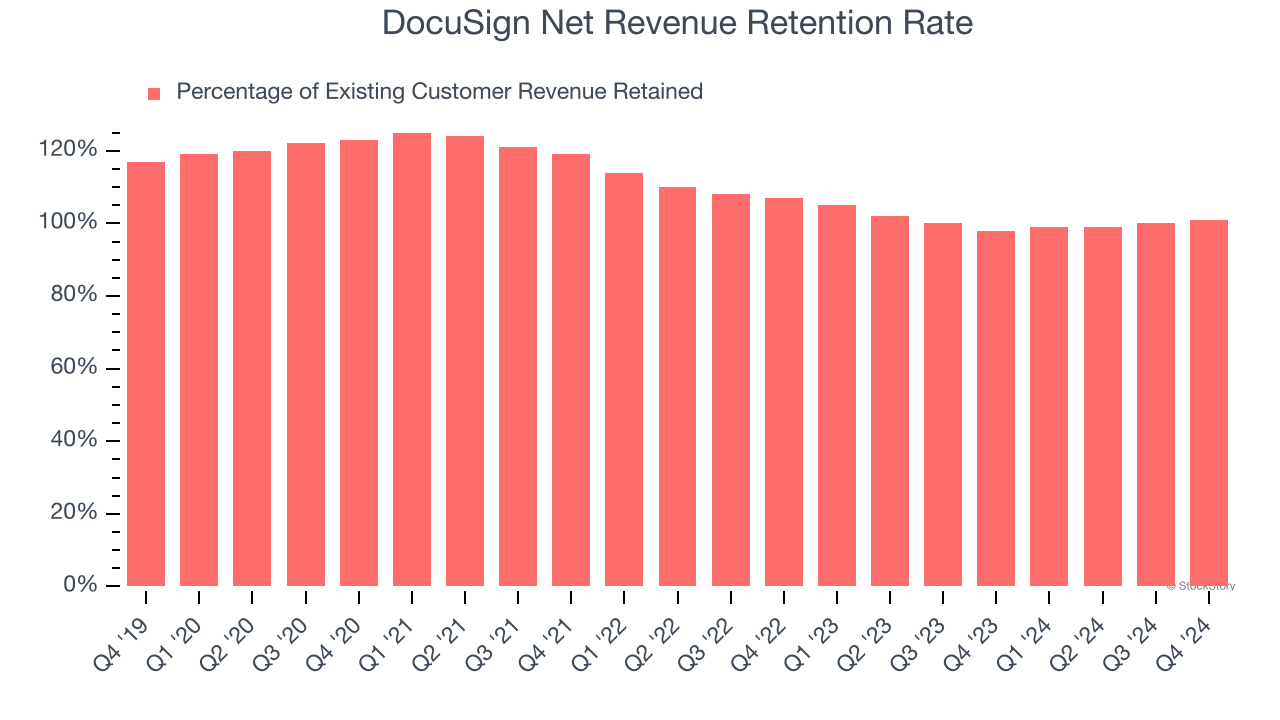

2. Customer Churn Hurts Long-Term Outlook

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

DocuSign’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 99.8% in Q4. This means DocuSign would’ve grown its revenue by -0.2% even if it didn’t win any new customers over the last 12 months.

Trending up over the last year, DocuSign has an adequate net retention rate, showing us that it generally keeps customers but lags behind the best SaaS businesses, which routinely post net retention rates of 120%+.

3. Long Payback Periods Delay Returns

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

DocuSign’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a highly competitive environment where there is little differentiation between DocuSign’s products and its peers.

Final Judgment

DocuSign isn’t a terrible business, but it doesn’t pass our bar. With its shares outperforming the market lately, the stock trades at 5.1× forward price-to-sales (or $75.30 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better stocks to buy right now. Let us point you toward a fast-growing restaurant franchise with an A+ ranch dressing sauce.

Stocks We Like More Than DocuSign

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.