Shareholders of Sotera Health Company would probably like to forget the past six months even happened. The stock dropped 28.2% and now trades at $11.07. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in Sotera Health Company, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons why we avoid SHC and a stock we'd rather own.

Why Is Sotera Health Company Not Exciting?

With a critical role in ensuring the safety of millions of patients worldwide, Sotera Health (NASDAQGS:SHC) provides sterilization services, lab testing, and advisory services to ensure medical devices, pharmaceuticals, and food products are safe for use.

1. Long-Term Revenue Growth Disappoints

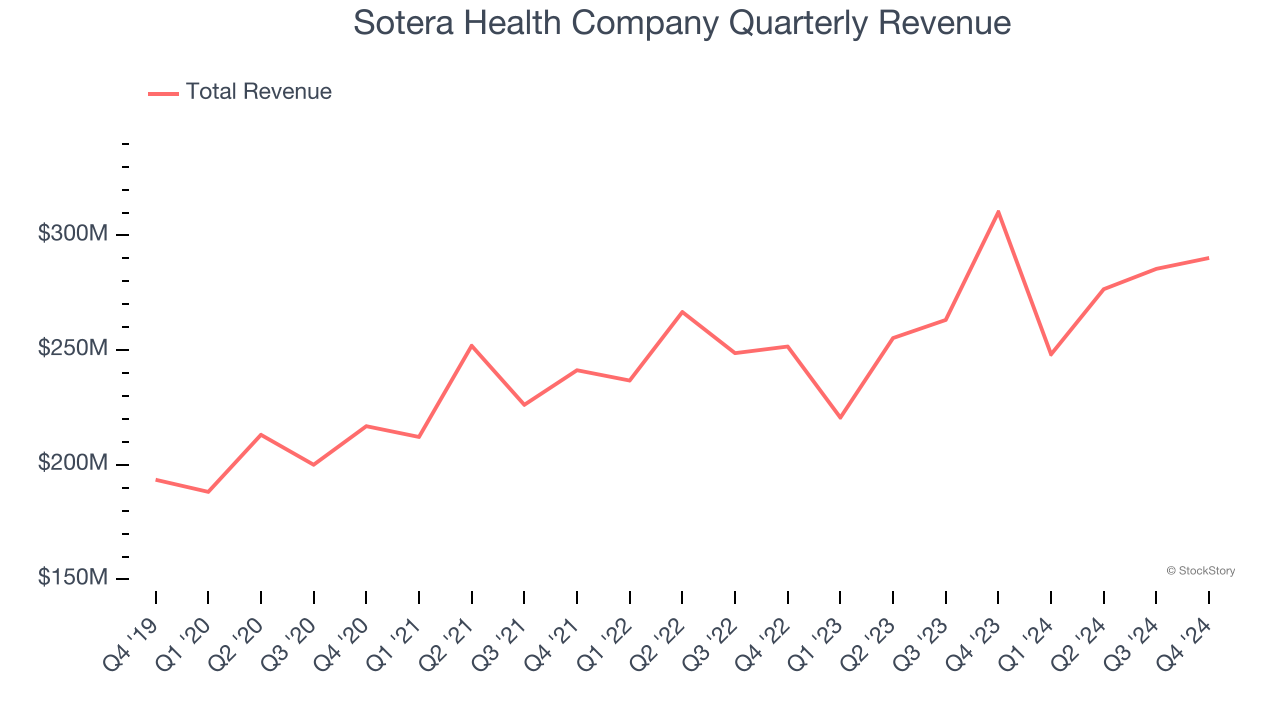

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Sotera Health Company grew its sales at a mediocre 7.2% compounded annual growth rate. This fell short of our benchmark for the healthcare sector.

2. Fewer Distribution Channels Limit its Ceiling

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $1.1 billion in revenue over the past 12 months, Sotera Health Company is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

3. Breakeven Free Cash Flow Limits Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

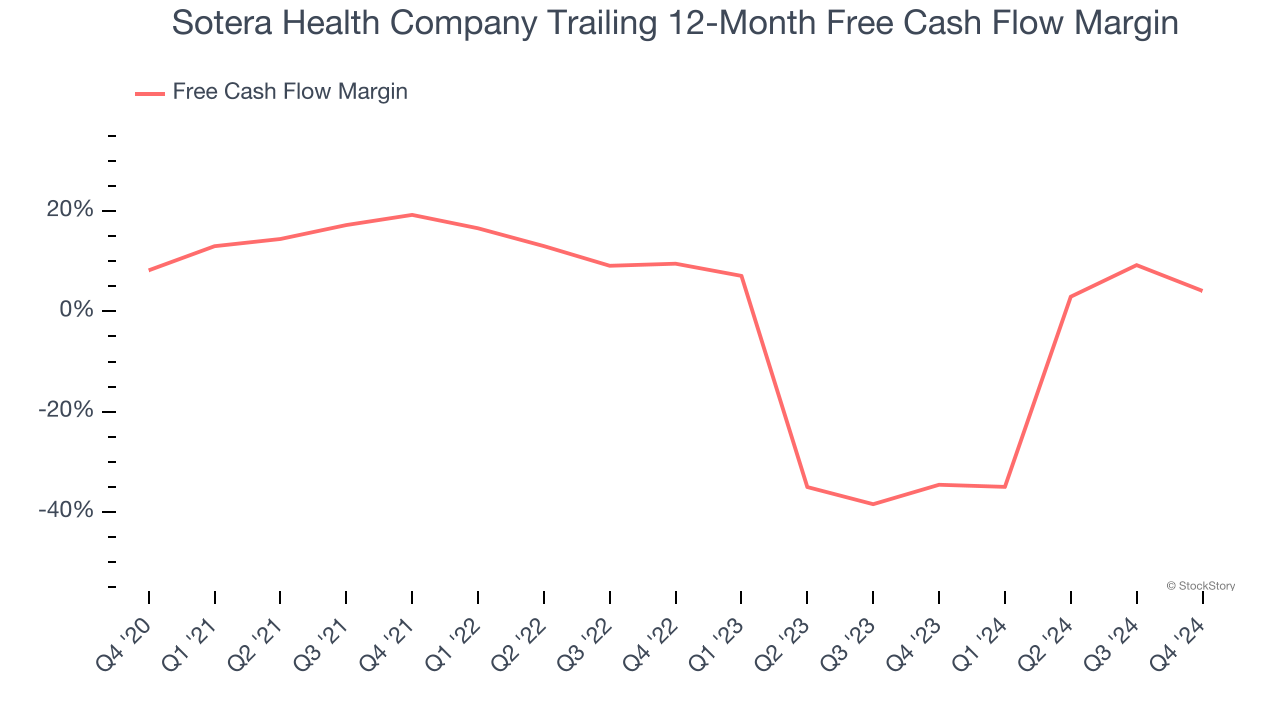

Sotera Health Company broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders. The divergence from its good adjusted operating margin stems from its capital-intensive business model, which requires Sotera Health Company to make large cash investments in working capital and capital expenditures.

Final Judgment

Sotera Health Company isn’t a terrible business, but it doesn’t pass our quality test. After the recent drawdown, the stock trades at 13.5× forward price-to-earnings (or $11.07 per share). Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're fairly confident there are better stocks to buy right now. We’d recommend looking at one of Charlie Munger’s all-time favorite businesses.

Stocks We Like More Than Sotera Health Company

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.