Earnings results often indicate what direction a company will take in the months ahead. With Q4 behind us, let’s have a look at Cushman & Wakefield (NYSE: CWK) and its peers.

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

The 13 real estate services stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 5.5% while next quarter’s revenue guidance was 1.2% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 20.4% since the latest earnings results.

Cushman & Wakefield (NYSE: CWK)

With expertise in the commercial real estate sector, Cushman & Wakefield (NYSE: CWK) is a global Chicago-based real estate firm offering a comprehensive range of services to clients.

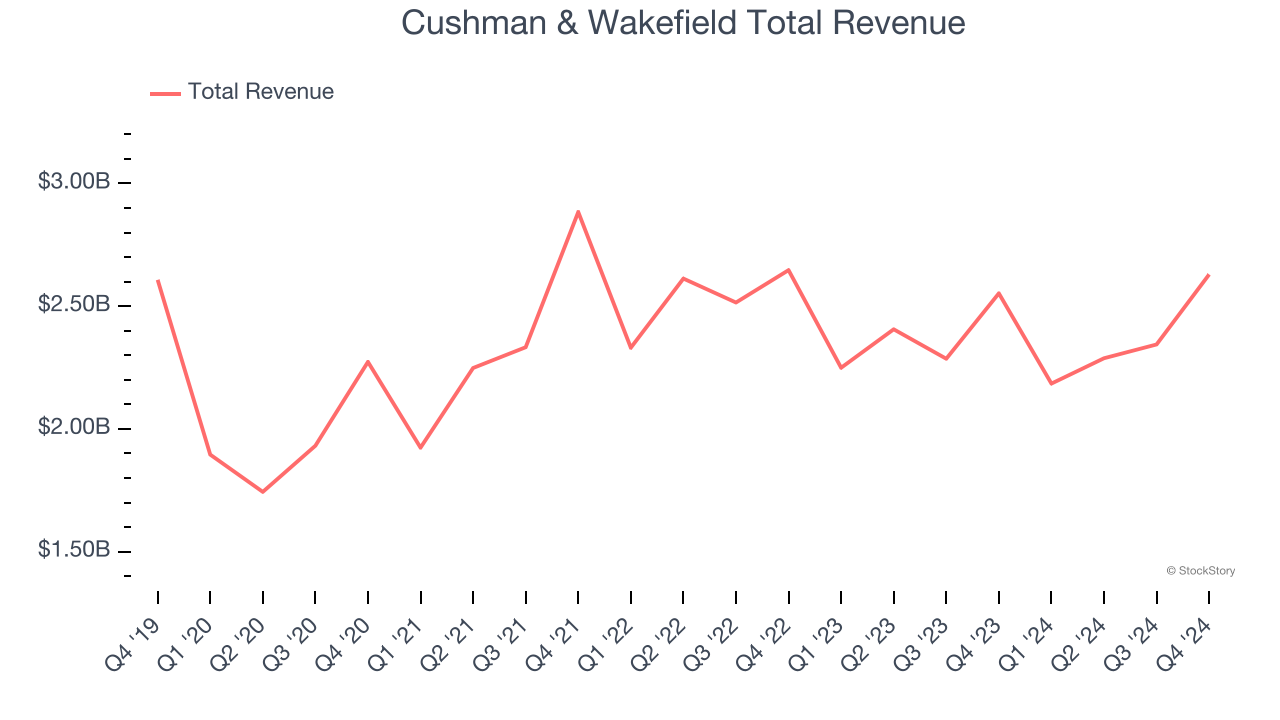

Cushman & Wakefield reported revenues of $2.63 billion, up 3% year on year. This print fell short of analysts’ expectations by 0.9%. Overall, it was a mixed quarter for the company with a narrow beat of analysts’ EBITDA estimates.

“We closed out 2024 with strong momentum in our business, reporting another quarter of solid Leasing revenue, our strongest Capital markets growth since the first quarter of 2022 and robust year-over-year improvement in free cash flow,” said Michelle MacKay, Chief Executive Officer of Cushman & Wakefield.

The stock is down 38% since reporting and currently trades at $8.07.

Read our full report on Cushman & Wakefield here, it’s free.

Best Q4: The Real Brokerage (NASDAQ: REAX)

Founded in Toronto, Canada in 2014, The Real Brokerage (NASDAQ: REAX) is a technology-driven real estate brokerage firm combining a tech-centric model with an agent-centric philosophy.

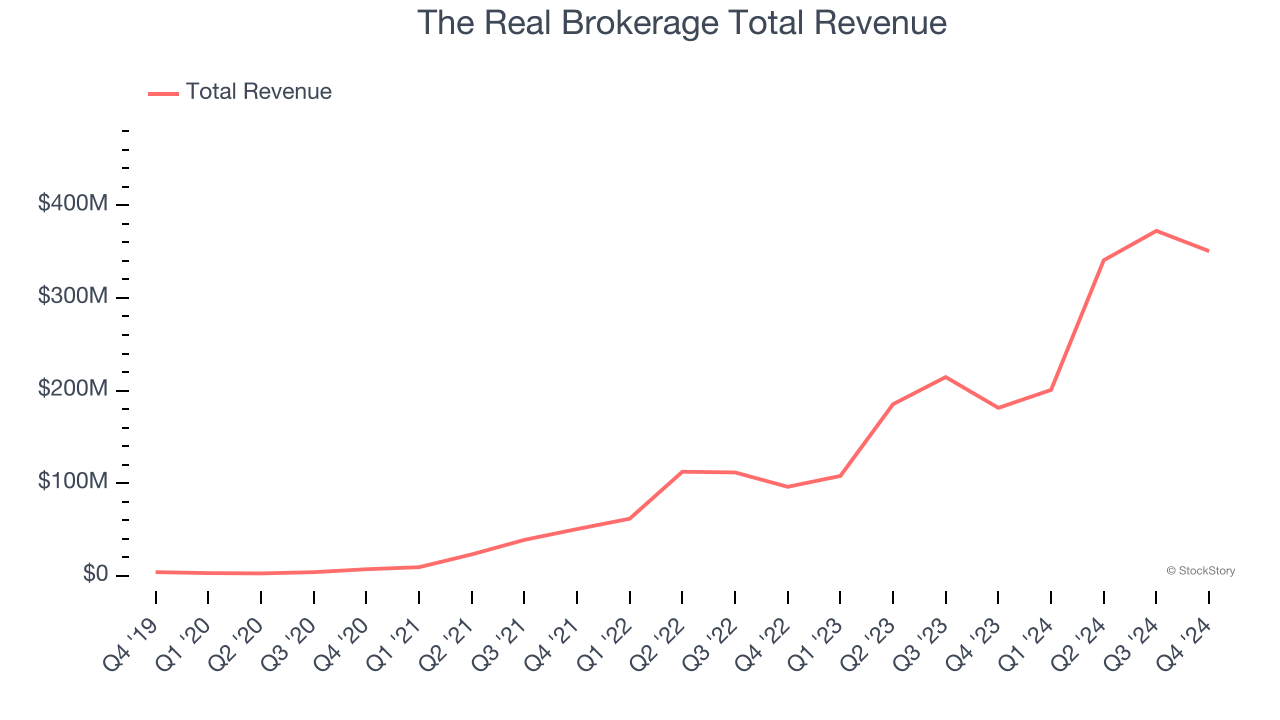

The Real Brokerage reported revenues of $350.6 million, up 93.4% year on year, outperforming analysts’ expectations by 16.8%. The business had an incredible quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The Real Brokerage pulled off the fastest revenue growth among its peers. The stock is down 10.8% since reporting. It currently trades at $4.42.

Is now the time to buy The Real Brokerage? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Offerpad (NYSE: OPAD)

Known for giving homeowners cash offers within 24 hours, Offerpad (NYSE: OPAD) operates a tech-enabled platform specializing in direct home buying and selling solutions.

Offerpad reported revenues of $174.3 million, down 27.5% year on year, in line with analysts’ expectations. It was a softer quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

Offerpad delivered the slowest revenue growth in the group. As expected, the stock is down 35.9% since the results and currently trades at $1.39.

Read our full analysis of Offerpad’s results here.

Opendoor (NASDAQ: OPEN)

Founded by real estate guru Eric Wu, Opendoor (NASDAQ: OPEN) offers a technology-driven, convenient, and streamlined process to buy and sell homes.

Opendoor reported revenues of $1.08 billion, up 24.6% year on year. This print surpassed analysts’ expectations by 10.8%. Aside from that, it was a satisfactory quarter as it also logged a solid beat of analysts’ EBITDA estimates.

The stock is down 27.8% since reporting and currently trades at $1.04.

Read our full, actionable report on Opendoor here, it’s free.

RE/MAX (NYSE: RMAX)

Short for Real Estate Maximums, RE/MAX (NYSE: RMAX) operates a real estate franchise network spanning over 100 countries and territories.

RE/MAX reported revenues of $72.47 million, down 5.4% year on year. This result lagged analysts' expectations by 2.7%. Overall, it was a softer quarter as it also recorded a significant miss of analysts’ adjusted operating income estimates.

RE/MAX had the weakest performance against analyst estimates and weakest full-year guidance update among its peers. The stock is down 29.2% since reporting and currently trades at $7.16.

Read our full, actionable report on RE/MAX here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.