Over the past six months, CTS’s shares (currently trading at $43.38) have posted a disappointing 19.8% loss while the S&P 500 was down 1%. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in CTS, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Do We Think CTS Will Underperform?

Despite the more favorable entry price, we're cautious about CTS. Here are three reasons why we avoid CTS and a stock we'd rather own.

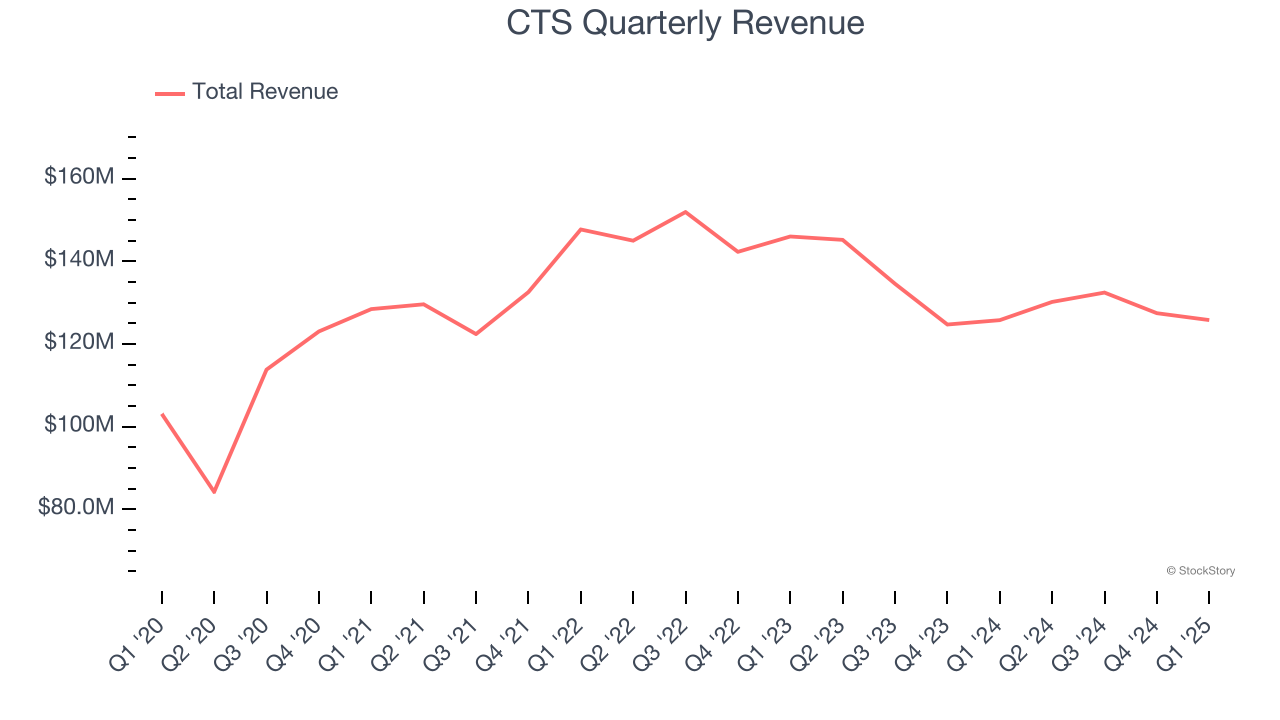

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, CTS’s 2.6% annualized revenue growth over the last five years was sluggish. This was below our standards.

2. Fewer Distribution Channels Limit its Ceiling

With $515.8 million in revenue over the past 12 months, CTS is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels.

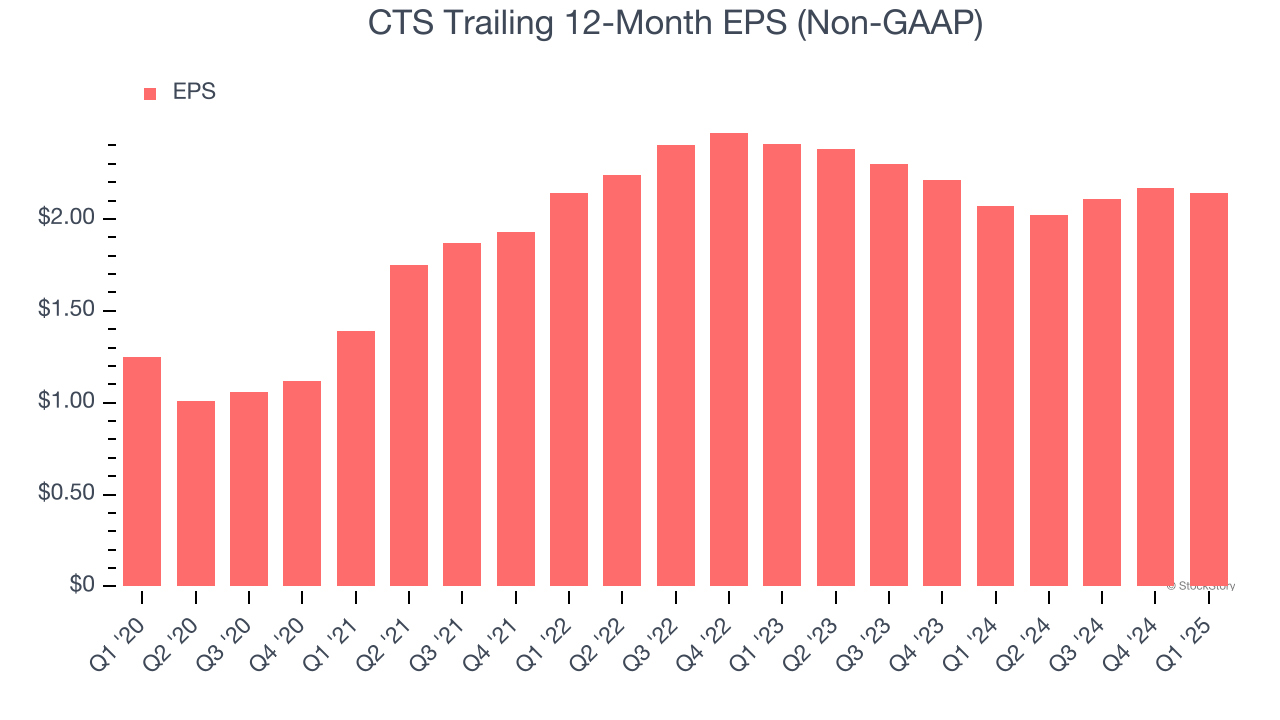

3. EPS Took a Dip Over the Last Two Years

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for CTS, its EPS and revenue declined by 5.8% and 6.1% annually over the last two years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, CTS’s low margin of safety could leave its stock price susceptible to large downswings.

Final Judgment

CTS doesn’t pass our quality test. After the recent drawdown, the stock trades at 20× forward P/E (or $43.38 per share). This valuation tells us a lot of optimism is priced in - we think there are better stocks to buy right now. Let us point you toward the most dominant software business in the world.

High-Quality Stocks for All Market Conditions

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 176% over the last five years.

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.