Since July 2020, the S&P 500 has delivered a total return of 97.8%. But one standout stock has doubled the market - over the past five years, Lam Research has surged 200% to $97.19 per share. Its momentum hasn’t stopped as it’s also gained 34.2% in the last six months thanks to its solid quarterly results, beating the S&P by 28.5%.

Following the strength, is LRCX a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Does Lam Research Spark Debate?

Founded in 1980 by David Lam, the man who pioneered semiconductor etching technology, Lam Research (NASDAQ: LRCX) is one of the leading providers of wafer fabrication equipment used to make semiconductors.

Two Things to Like:

1. Operating Margin Reveals a Well-Run Organization

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Lam Research has been a well-oiled machine over the last two years. It demonstrated elite profitability for a semiconductor business, boasting an average operating margin of 29.6%.

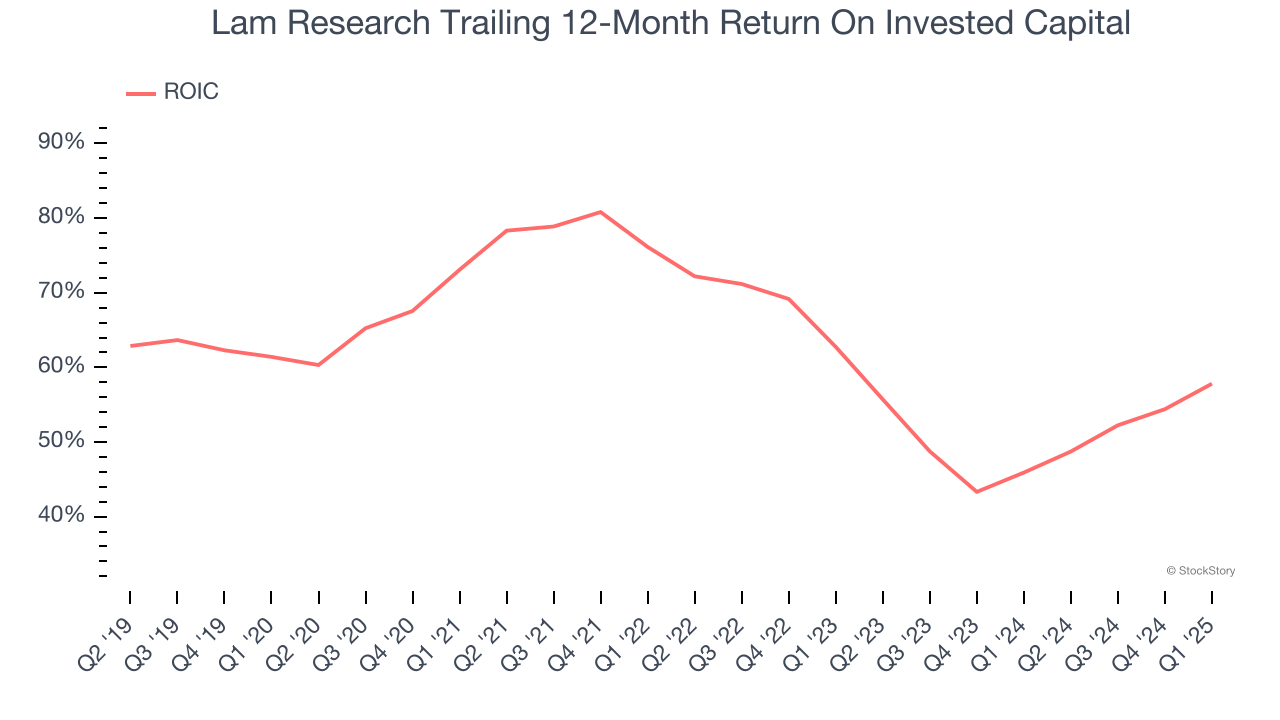

2. Stellar ROIC Showcases Lucrative Growth Opportunities

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Lam Research’s five-year average ROIC was 63.1%, placing it among the best semiconductor companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

One Reason to be Careful:

Revenue Tumbling Downwards

Long-term growth is the most important, but short-term results matter for semiconductors because the rapid pace of technological innovation (Moore's Law) could make yesterday's hit product obsolete today. Lam Research’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 4.7% over the last two years.

Final Judgment

Lam Research’s positive characteristics outweigh the negatives, and with its shares beating the market recently, the stock trades at 25.6× forward P/E (or $97.19 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.