Food ingredient solutions provider Ingredion (NYSE: INGR) missed Wall Street’s revenue expectations in Q3 CY2025, with sales falling 2.9% year on year to $1.82 billion. Its non-GAAP profit of $2.75 per share was 4.8% below analysts’ consensus estimates.

Is now the time to buy Ingredion? Find out by accessing our full research report, it’s free for active Edge members.

Ingredion (INGR) Q3 CY2025 Highlights:

- Revenue: $1.82 billion vs analyst estimates of $1.89 billion (2.9% year-on-year decline, 4% miss)

- Adjusted EPS: $2.75 vs analyst expectations of $2.89 (4.8% miss)

- Adjusted EBITDA: $311 million vs analyst estimates of $328.9 million (17.1% margin, 5.4% miss)

- Adjusted EPS guidance for the full year is $11.20 at the midpoint, missing analyst estimates by 1.5%

- Operating Margin: 13.7%, in line with the same quarter last year

- Free Cash Flow Margin: 9.5%, down from 22.9% in the same quarter last year

- Constant Currency Revenue fell 4% year on year, in line with the same quarter last year

- Market Capitalization: $7 billion

Company Overview

Known for its ability to turn ordinary corn into thousands of different food ingredients, Ingredion (NYSE: INGR) transforms grains, fruits, vegetables and other plant-based materials into specialty starches, sweeteners and other ingredients for food, beverage and industrial markets.

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $7.26 billion in revenue over the past 12 months, Ingredion is one of the larger consumer staples companies and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because it’s harder to find incremental growth when your existing brands have penetrated most of the market. To expand meaningfully, Ingredion likely needs to tweak its prices, innovate with new products, or enter new markets.

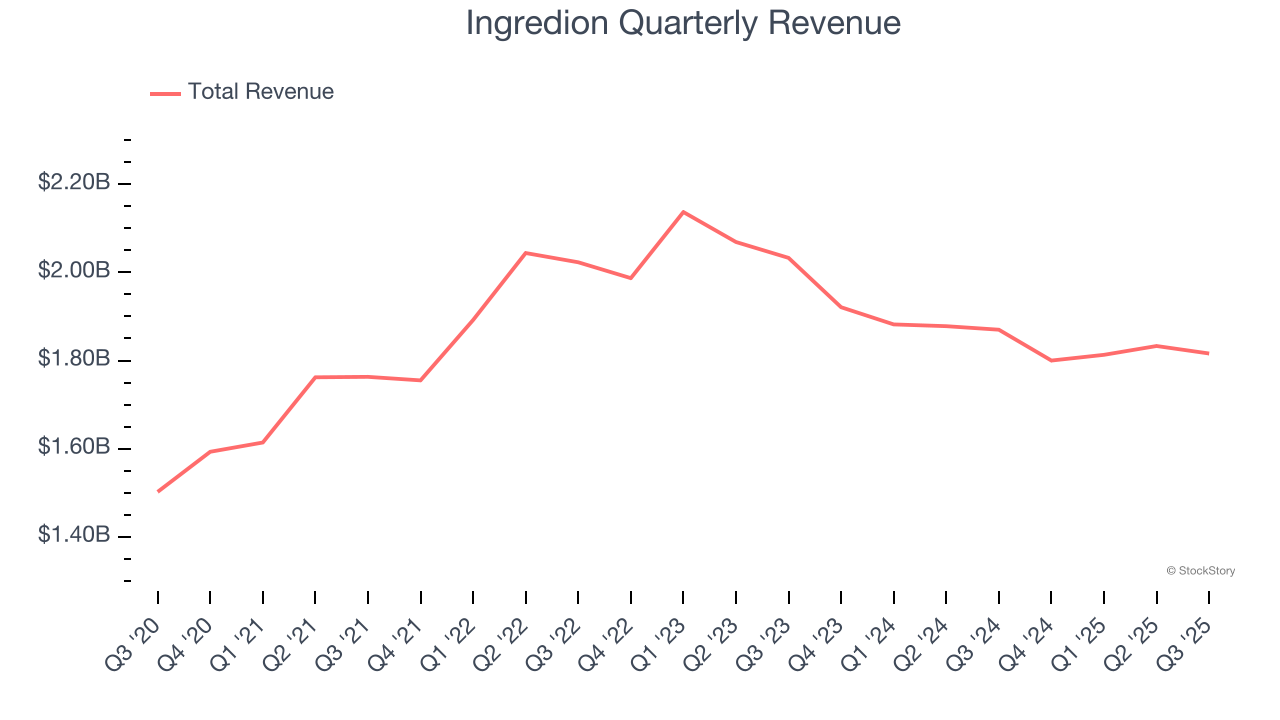

As you can see below, Ingredion struggled to generate demand over the last three years. Its sales dropped by 2% annually, a rough starting point for our analysis.

This quarter, Ingredion missed Wall Street’s estimates and reported a rather uninspiring 2.9% year-on-year revenue decline, generating $1.82 billion of revenue.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection suggests its newer products will catalyze better top-line performance, it is still below the sector average.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

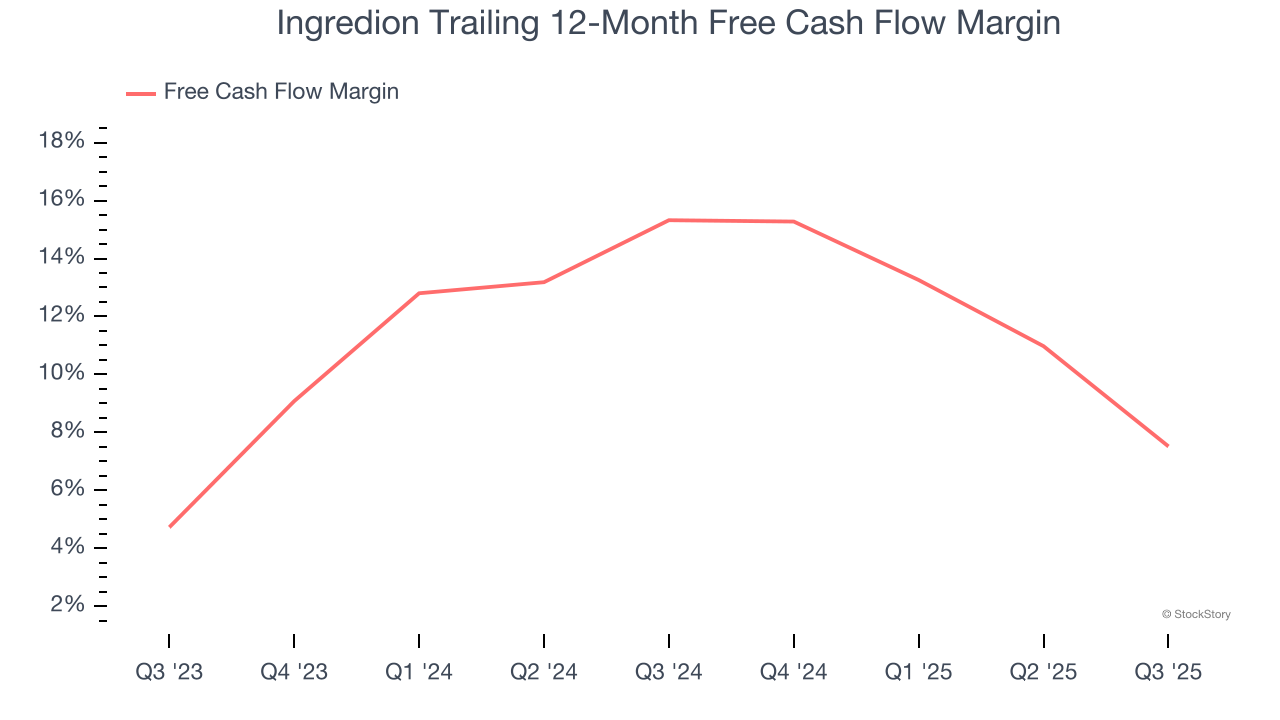

Ingredion has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 11.5% over the last two years, quite impressive for a consumer staples business.

Taking a step back, we can see that Ingredion’s margin dropped by 7.8 percentage points over the last year. If its declines continue, it could signal increasing investment needs and capital intensity.

Ingredion’s free cash flow clocked in at $172 million in Q3, equivalent to a 9.5% margin. The company’s cash profitability regressed as it was 13.5 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

Key Takeaways from Ingredion’s Q3 Results

We struggled to find many positives in these results. Its EBITDA missed and its revenue fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock remained flat at $110.30 immediately following the results.

So do we think Ingredion is an attractive buy at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.