Solventum trades at $79.45 per share and has stayed right on track with the overall market, gaining 7.3% over the last six months. At the same time, the S&P 500 has returned 11.3%.

Is now the time to buy Solventum, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Do We Think Solventum Will Underperform?

We don't have much confidence in Solventum. Here are three reasons we avoid SOLV and a stock we'd rather own.

1. Slow Organic Growth Suggests Waning Demand In Core Business

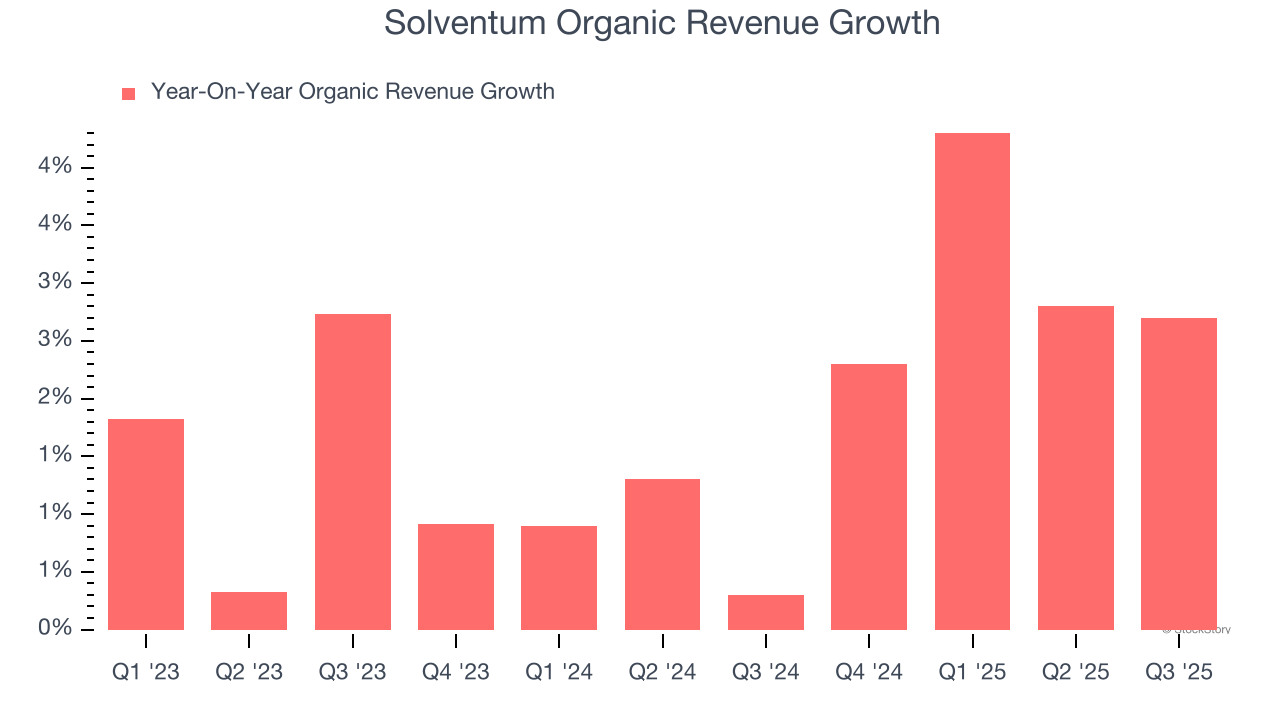

Investors interested in Surgical Equipment & Consumables - Diversified companies should track organic revenue in addition to reported revenue. This metric gives visibility into Solventum’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Solventum’s organic revenue averaged 1.9% year-on-year growth. This performance was underwhelming and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Solventum’s revenue to drop by 5.3%, a decrease from This projection doesn't excite us and implies its products and services will see some demand headwinds.

3. Free Cash Flow Margin Dropping

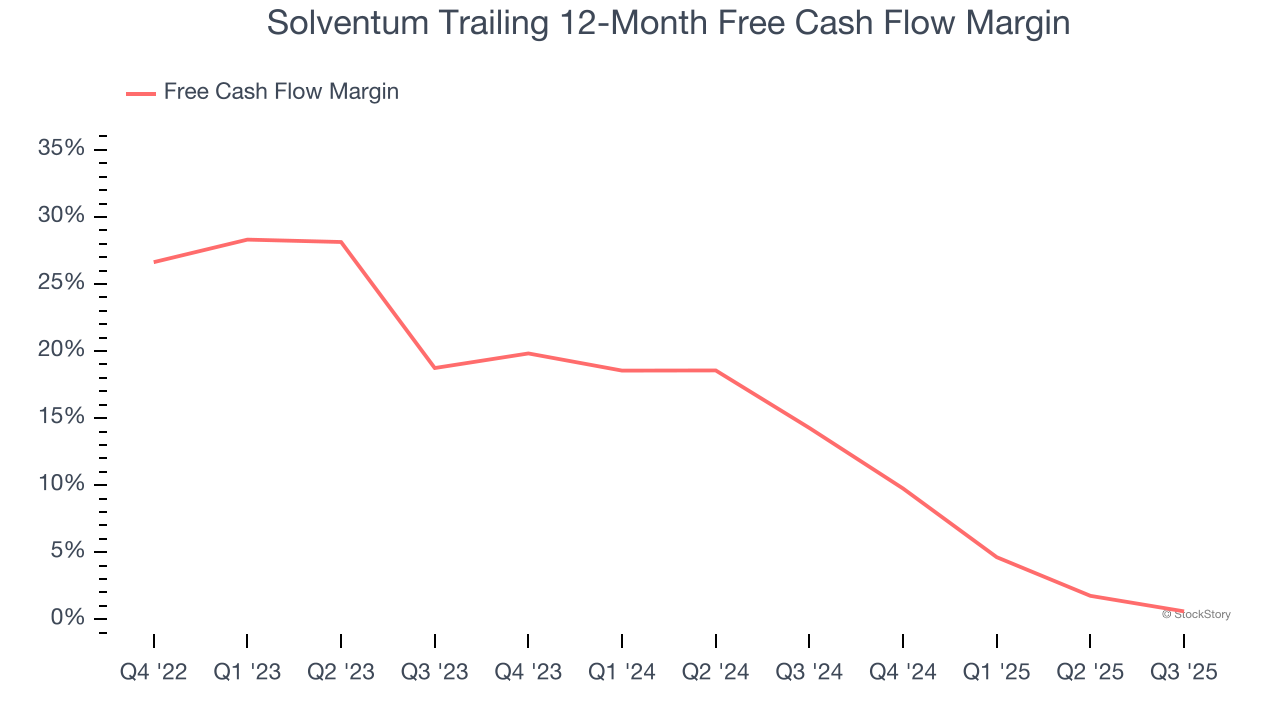

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Solventum’s margin dropped by 30.1 percentage points over the last four years. If its declines continue, it could signal increasing investment needs and capital intensity. Solventum’s free cash flow margin for the trailing 12 months was breakeven.

Final Judgment

We cheer for all companies helping people live better, but in the case of Solventum, we’ll be cheering from the sidelines. That said, the stock currently trades at 13.8× forward P/E (or $79.45 per share). At this valuation, there’s a lot of good news priced in - we think there are better stocks to buy right now. Let us point you toward our favorite semiconductor picks and shovels play.

Stocks We Would Buy Instead of Solventum

Check out the high-quality names we’ve flagged in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.