As the Q3 earnings season wraps, let’s dig into this quarter’s best and worst performers in the consumer internet industry, including Electronic Arts (NASDAQ: EA) and its peers.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 47 consumer internet stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 2% while next quarter’s revenue guidance was in line.

While some consumer internet stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.9% since the latest earnings results.

Electronic Arts (NASDAQ: EA)

Best known for its Madden NFL and FIFA sports franchises, Electronic Arts (NASDAQ: EA) is one of the world’s largest video game publishers.

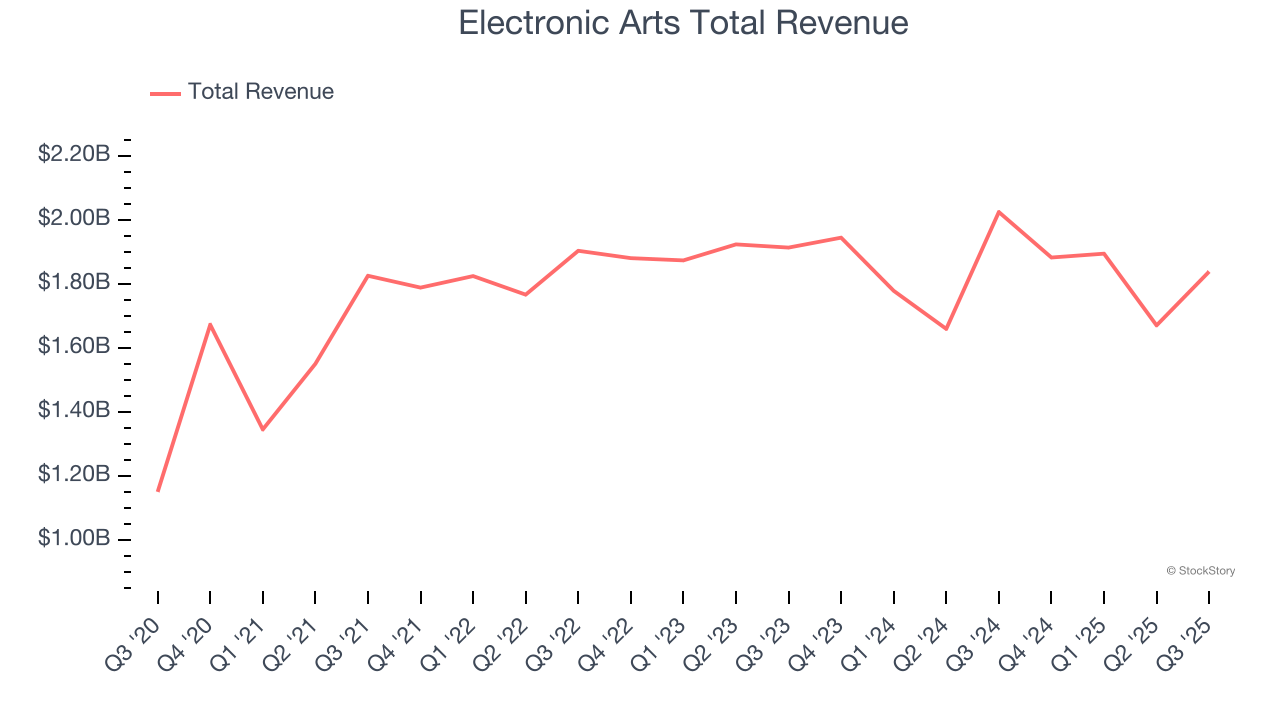

Electronic Arts reported revenues of $1.84 billion, down 9.2% year on year. This print exceeded analysts’ expectations by 1%. Despite the top-line beat, it was still a slower quarter for the company with a miss of analysts’ EBITDA estimates.

“Across our broad portfolio — from EA SPORTS to Battlefield, The Sims, and skate. — our teams continue to create high-quality experiences that connect and inspire players around the world,” said Andrew Wilson, CEO of Electronic Arts.

Interestingly, the stock is up 2.2% since reporting and currently trades at $204.70.

Is now the time to buy Electronic Arts? Access our full analysis of the earnings results here, it’s free for active Edge members.

Best Q3: EverQuote (NASDAQ: EVER)

Aiming to simplify a once complicated process, EverQuote (NASDAQ: EVER) is an online insurance marketplace where consumers can compare and purchase various types of insurance from different providers

EverQuote reported revenues of $173.9 million, up 20.3% year on year, outperforming analysts’ expectations by 4.3%. The business had an exceptional quarter with an impressive beat of analysts’ EBITDA estimates and revenue guidance for next quarter exceeding analysts’ expectations.

The market seems happy with the results as the stock is up 19.1% since reporting. It currently trades at $26.70.

Is now the time to buy EverQuote? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: ACV Auctions (NYSE: ACVA)

Founded in 2014, ACV Auctions (NASDAQ: ACVA) is an online auction marketplace for car dealers and wholesalers to buy and sell used cars.

ACV Auctions reported revenues of $199.6 million, up 16.5% year on year, in line with analysts’ expectations. It was a disappointing quarter as it posted full-year revenue guidance slightly missing analysts’ expectations and full-year EBITDA guidance missing analysts’ expectations significantly.

As expected, the stock is down 1.6% since the results and currently trades at $8.02.

Read our full analysis of ACV Auctions’s results here.

Udemy (NASDAQ: UDMY)

With courses ranging from investing to cooking to computer programming, Udemy (NASDAQ: UDMY) is an online learning platform that connects learners with expert instructors who specialize in a wide range of topics.

Udemy reported revenues of $195.7 million, flat year on year. This print beat analysts’ expectations by 1.4%. Zooming out, it was a satisfactory quarter as it also recorded a solid beat of analysts’ EBITDA estimates but revenue guidance for next quarter missing analysts’ expectations significantly.

The company reported 17,111 active buyers, up 1.6% year on year. The stock is down 8.3% since reporting and currently trades at $5.85.

Read our full, actionable report on Udemy here, it’s free for active Edge members.

DoorDash (NASDAQ: DASH)

Founded by Stanford students with the intent to build “the local, on-demand FedEx", DoorDash (NYSE: DASH) operates an on-demand food delivery platform.

DoorDash reported revenues of $3.45 billion, up 27.3% year on year. This number topped analysts’ expectations by 2.6%. Taking a step back, it was a slower quarter as it logged EBITDA guidance for next quarter missing analysts’ expectations significantly.

The company reported 776 million service requests, up 20.7% year on year. The stock is down 5.5% since reporting and currently trades at $225.88.

Read our full, actionable report on DoorDash here, it’s free for active Edge members.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.