Auto parts and accessories retailer O’Reilly Automotive (NASDAQ: ORLY) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 7.8% year on year to $4.41 billion. On the other hand, the company’s full-year revenue guidance of $18.85 billion at the midpoint came in 0.6% below analysts’ estimates. Its GAAP profit of $0.71 per share was 1.9% below analysts’ consensus estimates.

Is now the time to buy O'Reilly? Find out by accessing our full research report, it’s free.

O'Reilly (ORLY) Q4 CY2025 Highlights:

- Revenue: $4.41 billion vs analyst estimates of $4.39 billion (7.8% year-on-year growth, in line)

- EPS (GAAP): $0.71 vs analyst expectations of $0.72 (1.9% miss)

- Adjusted EBITDA: $972 million vs analyst estimates of $976.5 million (22% margin, in line)

- EPS (GAAP) guidance for the upcoming financial year 2026 is $3.15 at the midpoint, missing analyst estimates by 5%

- Operating Margin: 18.8%, in line with the same quarter last year

- Free Cash Flow Margin: 8.2%, similar to the same quarter last year

- Locations: 6,585 at quarter end, up from 6,378 in the same quarter last year

- Same-Store Sales rose 5.6% year on year (4.4% in the same quarter last year)

- Market Capitalization: $81.96 billion

Brad Beckham, O’Reilly’s CEO, commented, “I would like to thank our over 93,000 Team Members for their tremendous hard work and commitment while delivering a strong finish to 2025. Our Team continues to drive share gains on both sides of our business through excellent customer service and industry-leading parts availability, resulting in our fourth quarter comparable store sales growth of 5.6%. Our top-line results, coupled with strong gross margin performance, drove a 12% increase in operating profit dollars and a 13% increase in diluted earnings per share for the fourth quarter. We are pleased with our Team’s ability to capitalize on the investments we are making in our business and manage operating costs to provide exceptional customer service and capture market share; however, SG&A expenses again exceeded our expectations in the fourth quarter due to pressure from heightened inflation in team member health care and casualty claim costs. We remain intensely focused on managing expenses and mitigating these cost pressures but will always prioritize delivering the service levels and parts availability in our stores that are critical to winning share and driving industry-leading results.”

Company Overview

Serving both the DIY customer and professional mechanic, O’Reilly Automotive (NASDAQ: ORLY) is an auto parts and accessories retailer that sells everything from fuel pumps to car air fresheners to mufflers.

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $17.78 billion in revenue over the past 12 months, O'Reilly is one of the larger companies in the consumer retail industry and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because there are only a finite number of places to build new stores, making it harder to find incremental growth. For O'Reilly to boost its sales, it likely needs to adjust its prices or lean into foreign markets.

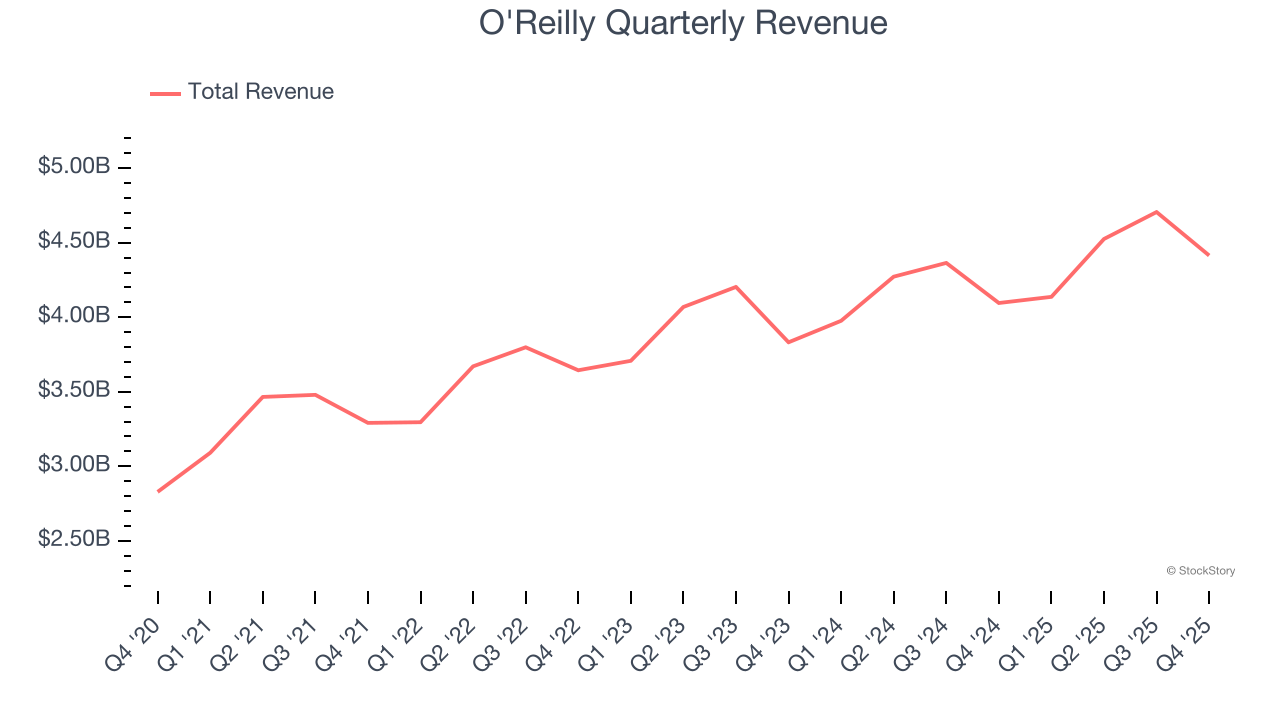

As you can see below, O'Reilly’s 7.3% annualized revenue growth over the last three years was tepid, but to its credit, it opened new stores and increased sales at existing, established locations.

This quarter, O'Reilly grew its revenue by 7.8% year on year, and its $4.41 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 6.5% over the next 12 months, similar to its three-year rate. This projection is particularly noteworthy for a company of its scale and indicates the market is baking in success for its products.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Store Performance

Number of Stores

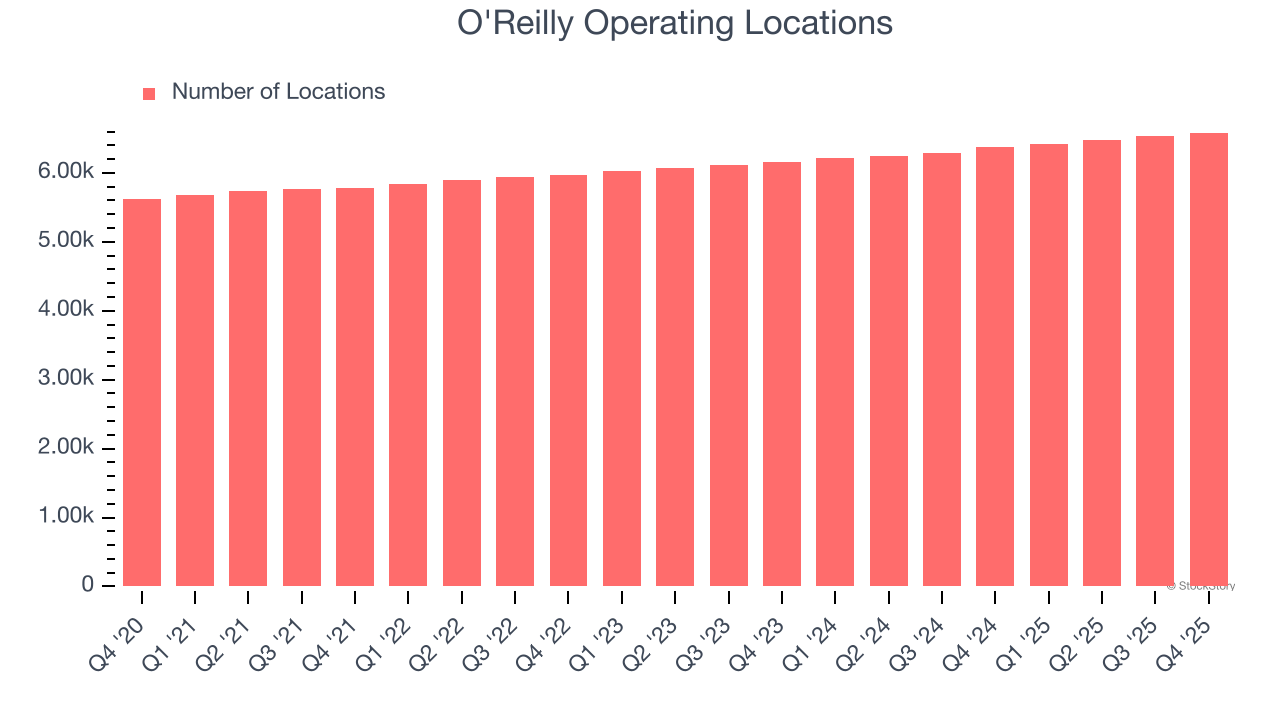

O'Reilly operated 6,585 locations in the latest quarter. It has opened new stores quickly over the last two years, averaging 3.3% annual growth, faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

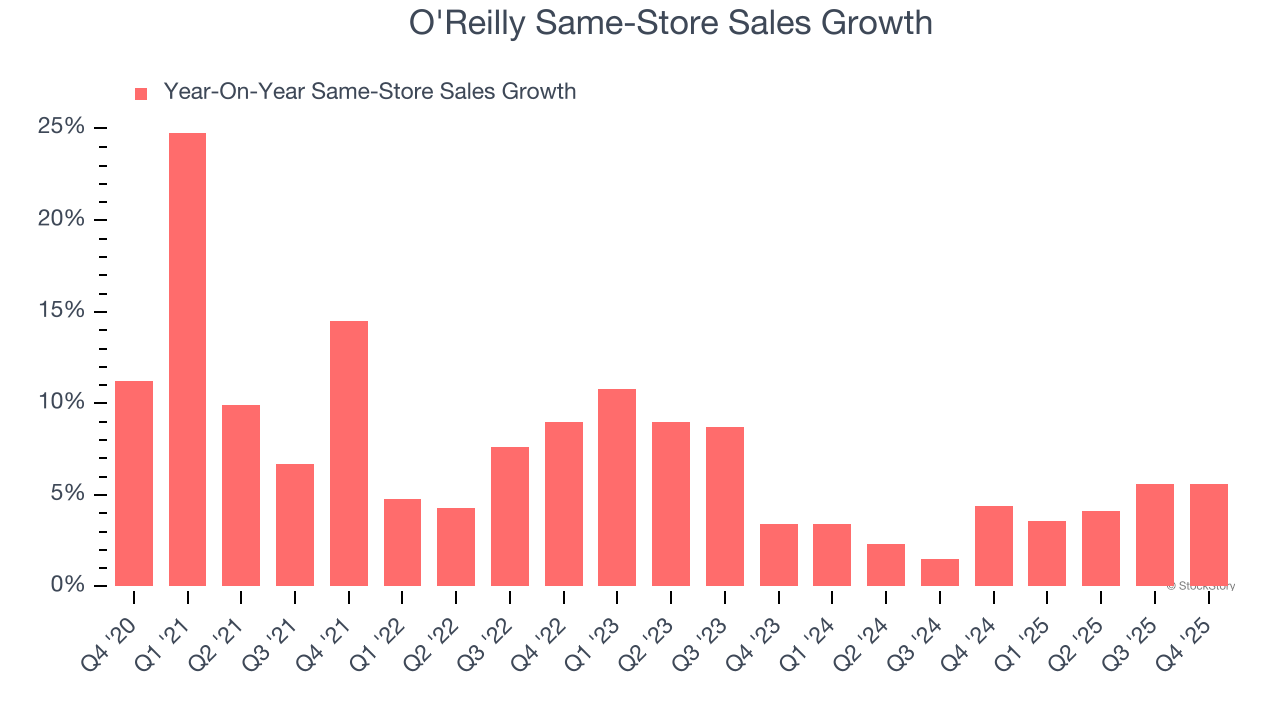

O'Reilly’s demand has been spectacular for a retailer over the last two years. On average, the company has increased its same-store sales by an impressive 3.8% per year. This performance suggests its rollout of new stores is beneficial for shareholders. We like this backdrop because it gives O'Reilly multiple ways to win: revenue growth can come from new stores, e-commerce, or increased foot traffic and higher sales per customer at existing locations.

In the latest quarter, O'Reilly’s same-store sales rose 5.6% year on year. This growth was an acceleration from its historical levels, which is always an encouraging sign.

Key Takeaways from O'Reilly’s Q4 Results

It was good to see O'Reilly meet analysts’ revenue expectations this quarter. We were also happy its gross margin narrowly outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance missed and its full-year revenue guidance fell slightly short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 3.4% to $93.49 immediately following the results.

O'Reilly’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here (it’s free).