Industrials products and automation company Regal Rexnord (NYSE: RRX). fell short of the market’s revenue expectations in Q4 CY2025 as sales rose 4.3% year on year to $1.52 billion. Its non-GAAP profit of $2.51 per share was 1.1% above analysts’ consensus estimates.

Is now the time to buy Regal Rexnord? Find out by accessing our full research report, it’s free.

Regal Rexnord (RRX) Q4 CY2025 Highlights:

- Revenue: $1.52 billion vs analyst estimates of $1.54 billion (4.3% year-on-year growth, 1.2% miss)

- Adjusted EPS: $2.51 vs analyst estimates of $2.48 (1.1% beat)

- Adjusted EBITDA: $328.5 million vs analyst estimates of $332.4 million (21.6% margin, 1.2% miss)

- Adjusted EPS guidance for the upcoming financial year 2026 is $10.60 at the midpoint, missing analyst estimates by 1.4%

- Operating Margin: 10.8%, up from 8.8% in the same quarter last year

- Free Cash Flow Margin: 9.2%, down from 12.6% in the same quarter last year

- Organic Revenue rose 2.9% year on year (miss)

- Market Capitalization: $11.36 billion

CEO Louis Pinkham commented, "We continued to gain significant momentum in the fourth quarter, most notably by achieving strong acceleration in our orders. The highlight was success with our recently launched E-Pod offering for the data center market, where we secured orders worth approximately $735 million for multiple projects, further cementing our position as an emerging scale player in data center power management. Our success in data center is driven by our strategy of making growth investments in secular markets. We are pursuing the same growth strategy in robotics for humanoids, cobots, and surgical robots; in aerospace and defense, with our electromechanical actuation solutions for eVTOLs, along with other sub-system opportunities; and in air moving for thermal management and for air filtration in clean rooms."

Company Overview

Headquartered in Milwaukee, Regal Rexnord (NYSE: RRX) provides power transmission and industrial automation products.

Revenue Growth

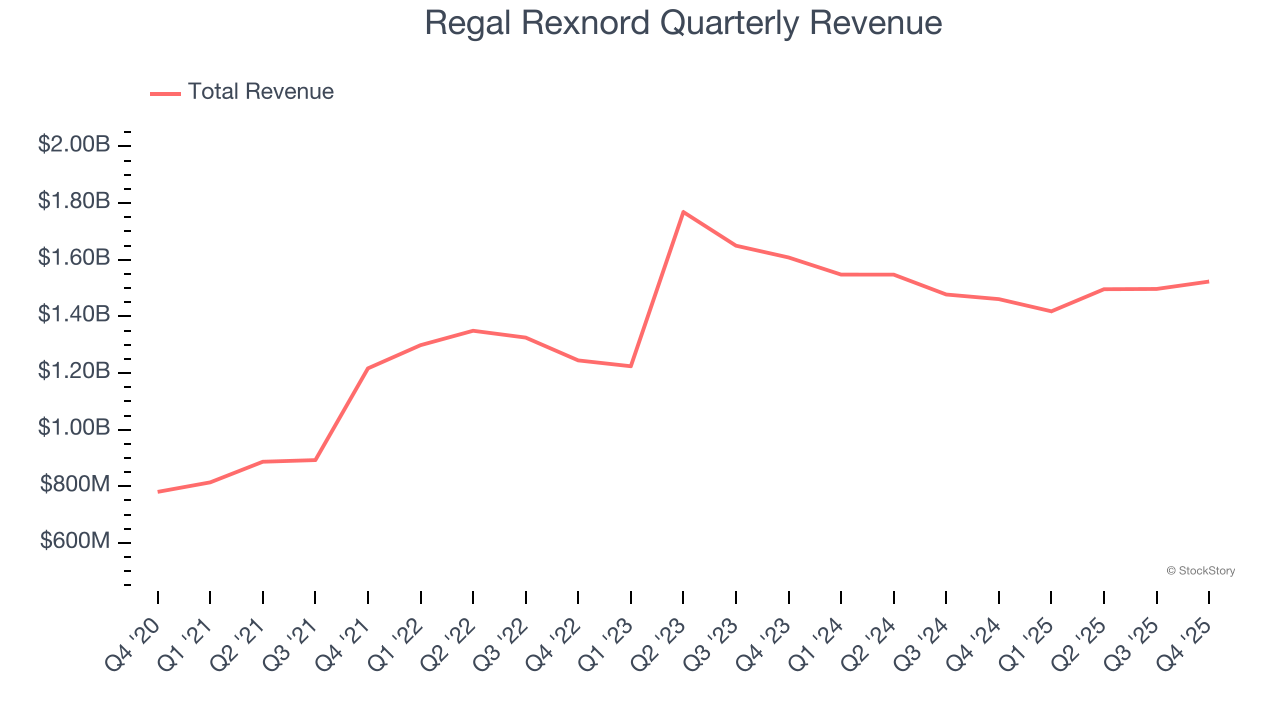

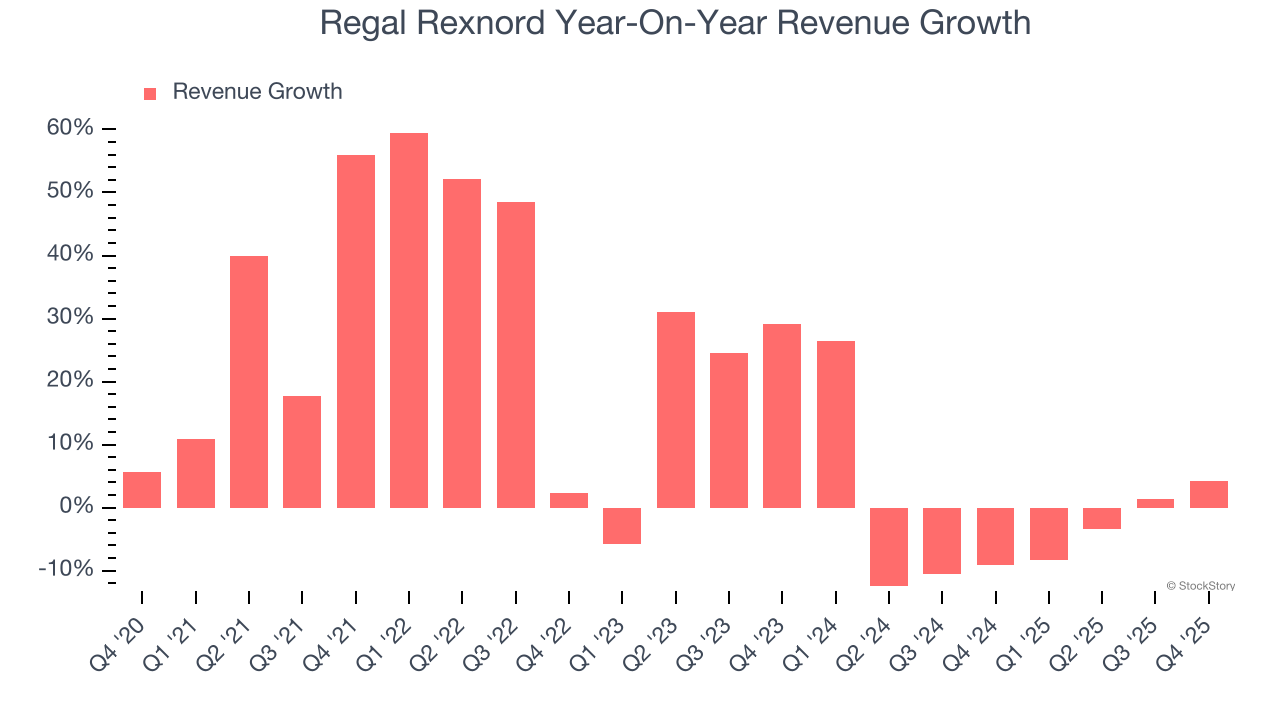

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, Regal Rexnord’s 15.3% annualized revenue growth over the last five years was incredible. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Regal Rexnord’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 2.6% over the last two years.

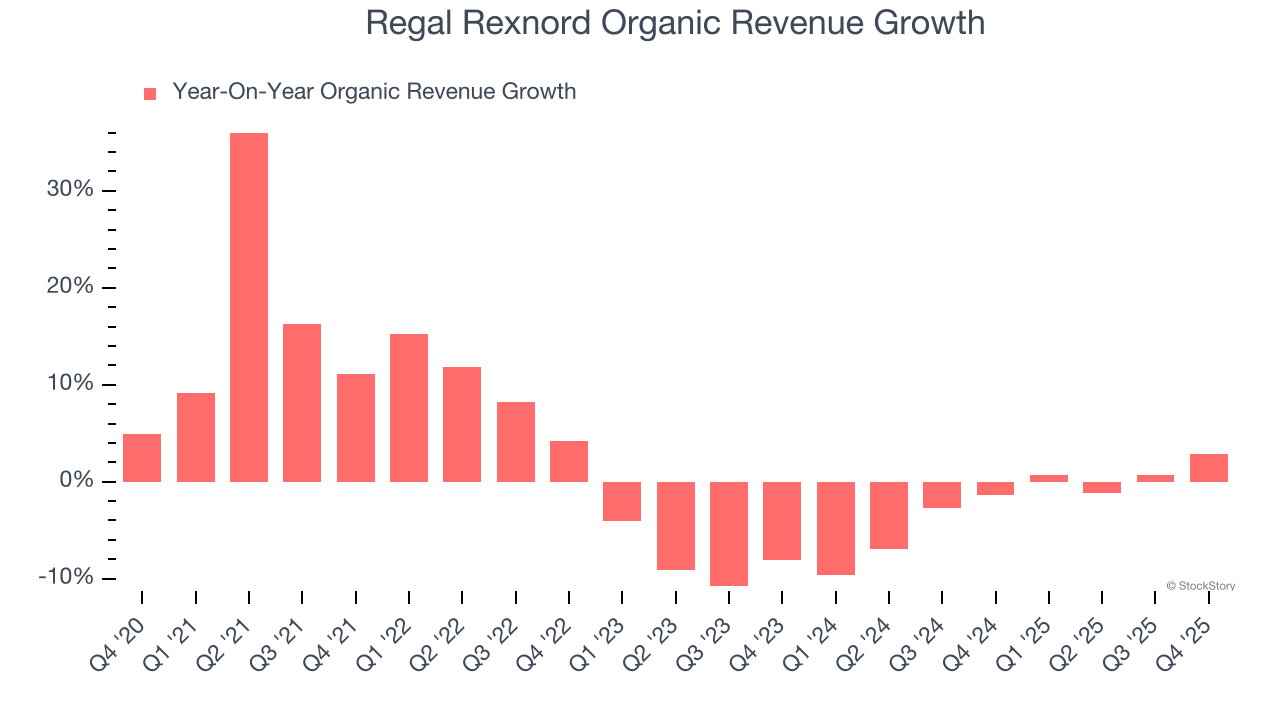

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Regal Rexnord’s organic revenue averaged 2.2% year-on-year declines. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Regal Rexnord’s revenue grew by 4.3% year on year to $1.52 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.8% over the next 12 months. Although this projection implies its newer products and services will spur better top-line performance, it is still below average for the sector.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Operating Margin

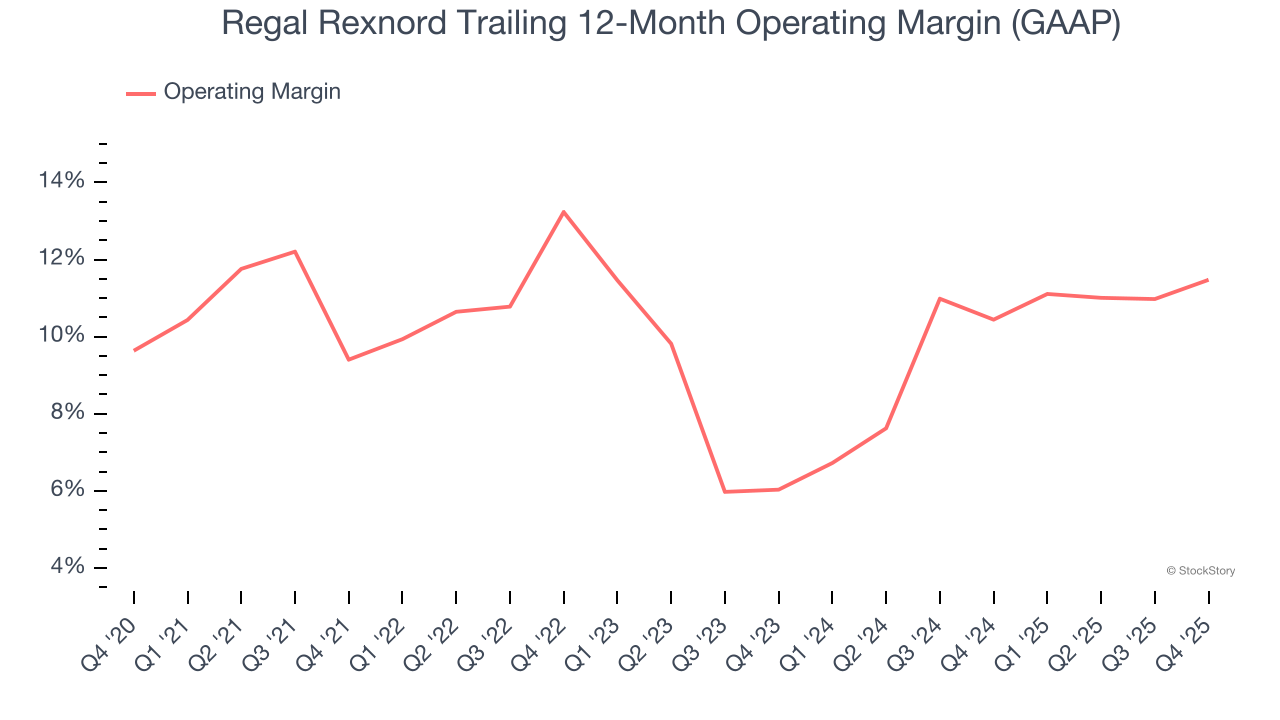

Regal Rexnord has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 10%. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Regal Rexnord’s operating margin rose by 2.1 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Regal Rexnord generated an operating margin profit margin of 10.8%, up 2 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

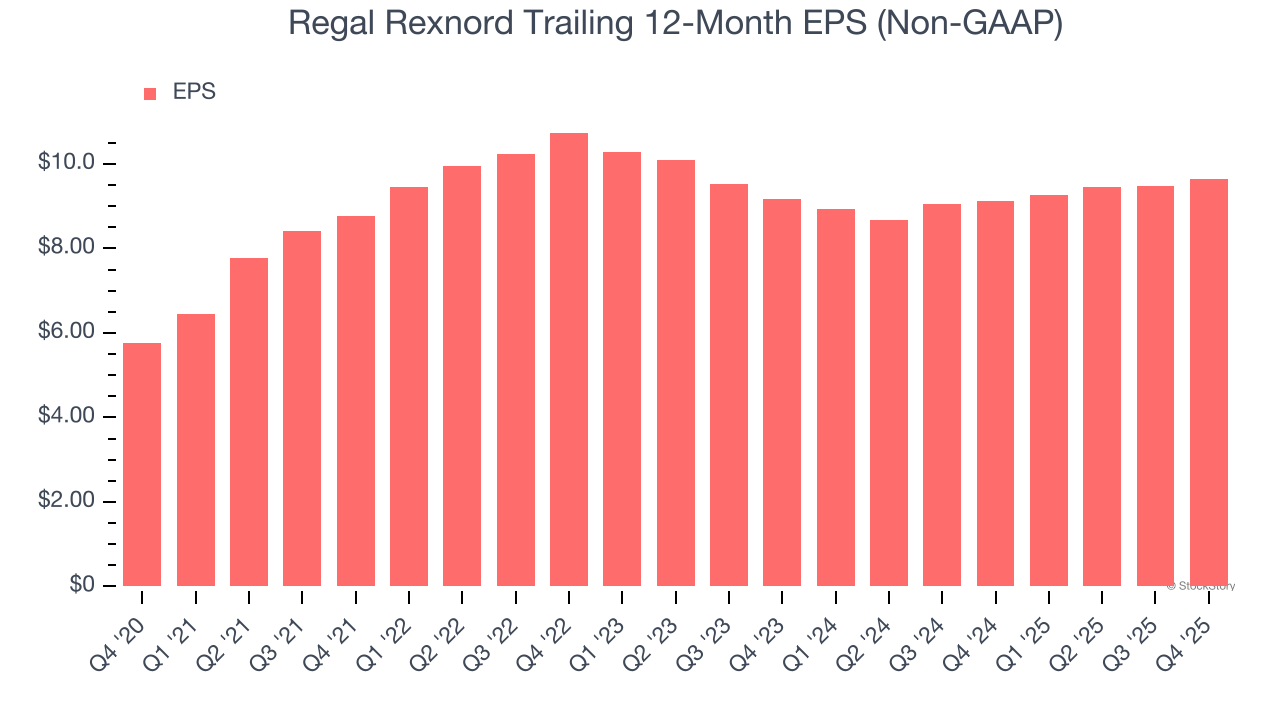

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

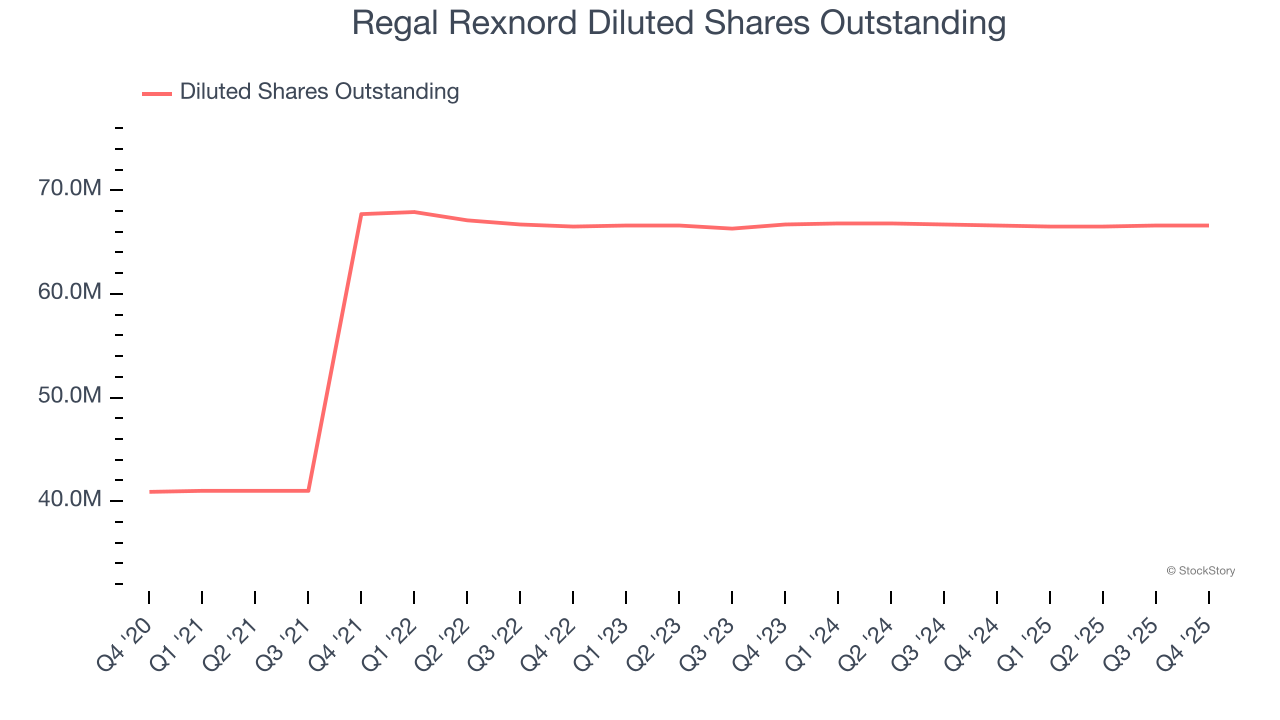

Regal Rexnord’s EPS grew at a solid 10.8% compounded annual growth rate over the last five years. Despite its operating margin improvement during that time, this performance was lower than its 15.3% annualized revenue growth, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

Diving into the nuances of Regal Rexnord’s earnings can give us a better understanding of its performance. A five-year view shows Regal Rexnord has diluted its shareholders, growing its share count by 62.8%. This dilution overshadowed its increased operational efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Regal Rexnord, its two-year annual EPS growth of 2.6% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, Regal Rexnord reported adjusted EPS of $2.51, up from $2.34 in the same quarter last year. This print beat analysts’ estimates by 1.1%. Over the next 12 months, Wall Street expects Regal Rexnord’s full-year EPS of $9.65 to grow 11.8%.

Key Takeaways from Regal Rexnord’s Q4 Results

We struggled to find many positives in these results. Its revenue slightly missed and its full-year EPS guidance fell slightly short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded up 2.3% to $182.50 immediately after reporting.

Big picture, is Regal Rexnord a buy here and now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here (it’s free).