Uniswap UNI/USD is one of the most popular decentralized trading protocols out there that facilitates automated trading for decentralized finance (DeFi) tokens.

Chainlink LINK/USD is a blockchain abstraction layer that enables smart contracts to be universally connected and allows blockchains to interact with external data feeds, events, and payment methods.

Aave AAVE/USD is a decentralized finance protocol that allows people to lend and borrow cryptocurrencies where they can earn interest.

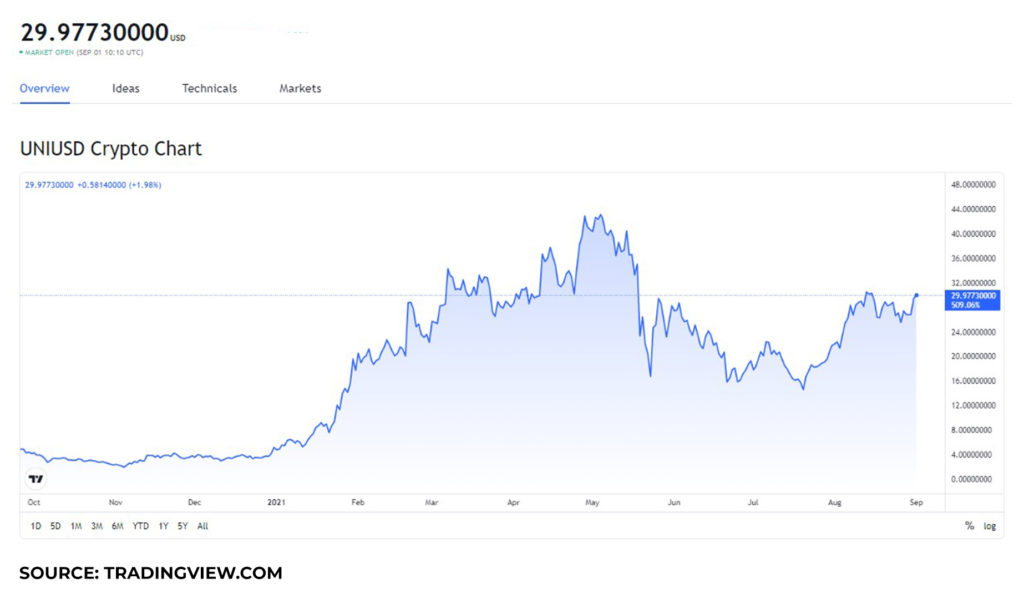

Should you invest in Uniswap (UNI)?On September 1, Uniswap (UNI) had a value of $29.97.

To further analyze this value and see how it stacks up, we’ll be going over the all-time high value as well as the recent performance throughout August.

UNI had its all-time high on May 3, where it got up to $44.92. This made it just 50% higher in value when compared to the value on September 1.

On August 4, UNI had its lowest point of $20.96. Later on, it climbed up to $31.01 on August 16, making it the highest point of the month. Here, we can see an increase of 47%.

Given this fact and its increase in trading volume by 63% in the last 24 hours, UNI is a worthwhile investment as it can climb up to $35 by the end of September.

Should you invest in Chainlink (LINK)?On September 1, Chainlink (LINK) had a value of $27.51.

We’ll check out August’s performance of the LINK token and compare it to its recent value as well as it’s all-time high just so we can see what kind of value point this is.

LINK had its all-time high on May 10, where it got up to $52.70. This made it 91% higher in value than on September 1.

Its lowest point in August was on August 2, where it fell to $21.55 in value. Its highest point, however, was on August 16 where it got up to $30.09. Here we can see an increase in value by 40%.

This makes LINK a worthwhile investment as it can climb to $32 by the end of September.

Should you invest in Aave (AAVE)?On September 1, Aave (AAVE) had a value of $399.

To get a heightened perspective as to what kind of value point this is, we’ll be comparing it to August’s performance and it’s all-time high.

AAVE had its all-time high on May 18, where it got up to $661. This made it 65% higher in value than on September 1.

On August 4, AAVE had its lowest value of the month at $303. Later on, on August 16, it climbed to $433, which marked its highest point. Here, we can see an increase of 42%.

That being said, AAVE has the potential to climb up to $430 by the end of September, making it a worthwhile investment.

The post I’m investing in UNI, LINK, and AAVE in September of 2021, and this is why! appeared first on Invezz.