China Evergrande Group (OP:EGRNF)

All News about China Evergrande Group

Is This A Stock Market Rally, Or Merely A Bounce? ↗

December 12, 2021

Via Talk Markets

Topics

Stocks

Tuesday Talk: Swingtime in December ↗

December 07, 2021

Via Talk Markets

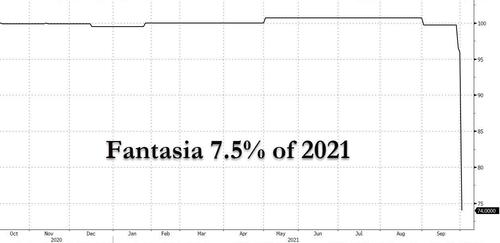

Evergrande, Bitcoin, And Conference Confirmations ↗

October 23, 2021

Via Talk Markets

Evergrande Sold Two Gulfstream G650 Jets To Repay Foreign Creditors ↗

November 06, 2021

Via Talk Markets

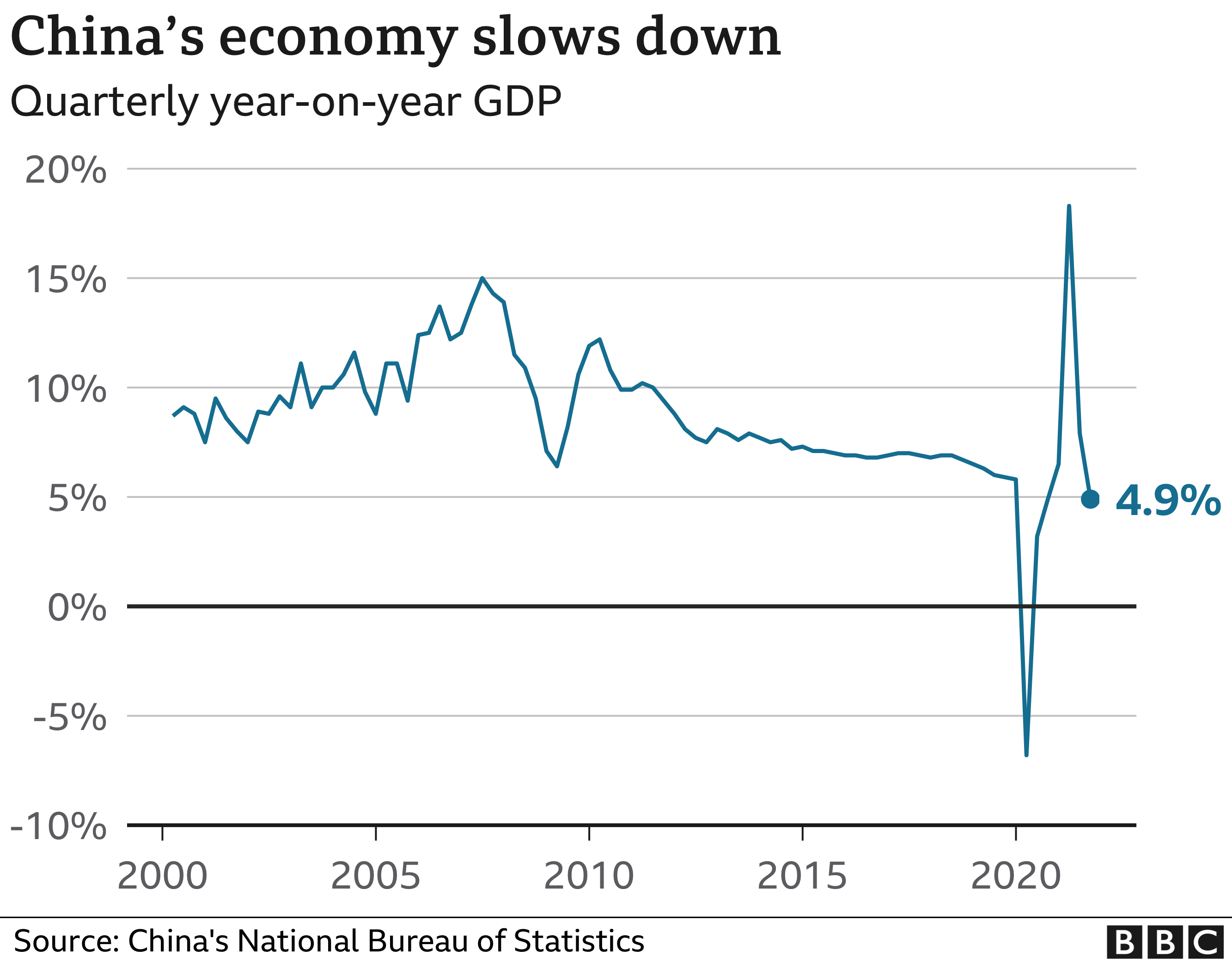

Mandarin Monday – China’s Economy Slows Considerably ↗

October 18, 2021

Via Talk Markets

Topics

Economy

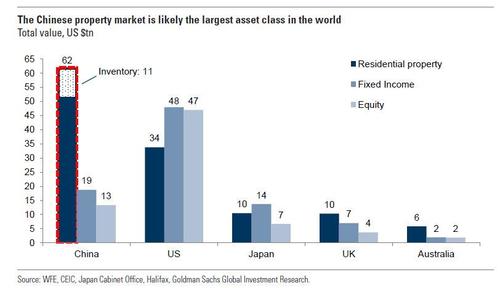

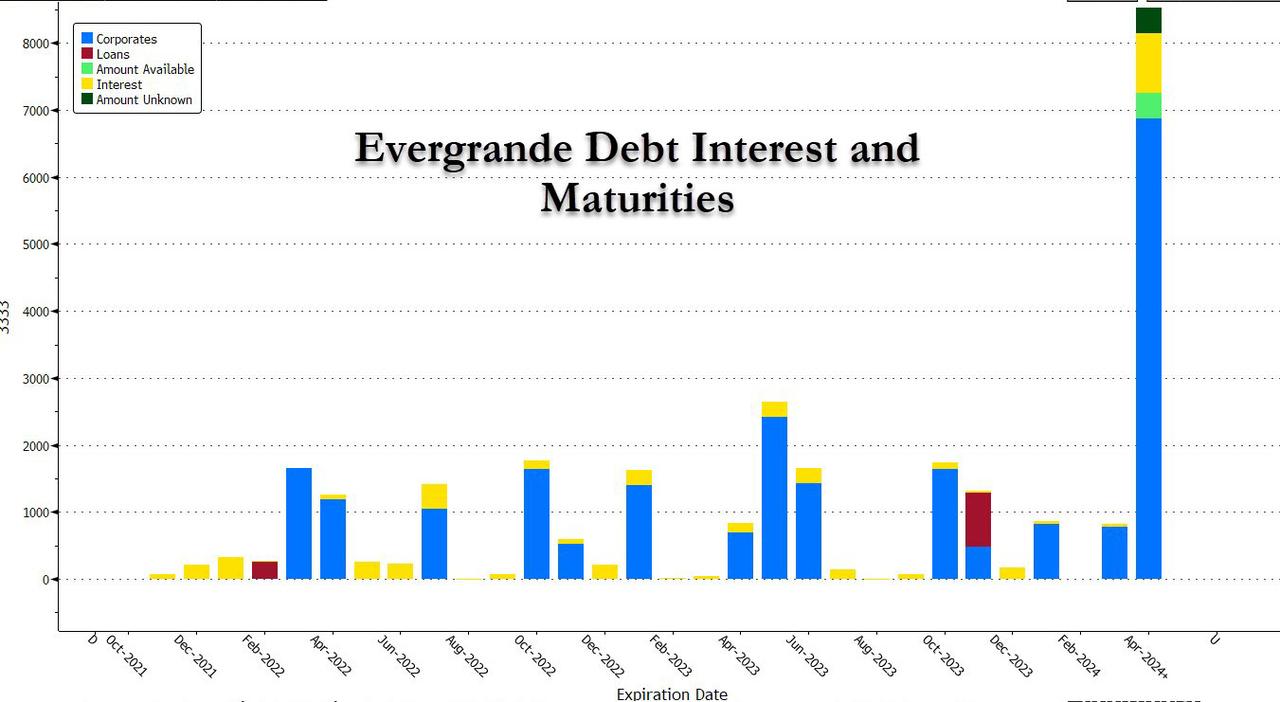

Just How Big Is China's Property Sector, And Two Key Questions On Policy And Tail Risks ↗

October 16, 2021

Via Talk Markets

Topics

Bonds

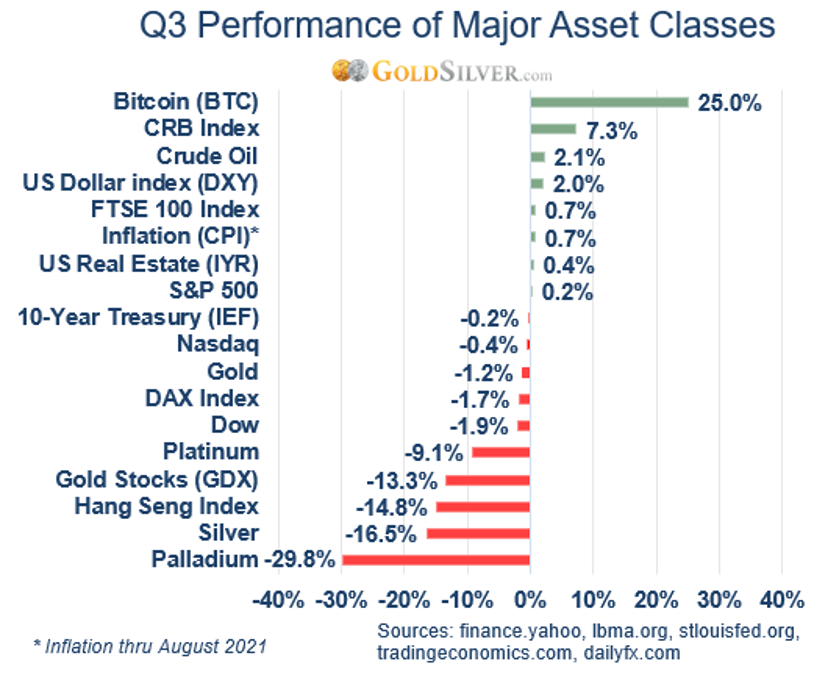

Gold In Q3: Rising Yields Pressure The Metal, But Catalysts Loom ↗

October 16, 2021

Via Talk Markets

Via Talk Markets

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.