iShares 20+ Year Treasury Bond ETF (NQ:TLT)

All News about iShares 20+ Year Treasury Bond ETF

Reinversion Continues

March 01, 2025

Via Talk Markets

Topics

Bonds

Via Talk Markets

CoT: Peek Into Future Thru Futures, Hedge Fund Positioning

March 09, 2025

Via Talk Markets

Trump’s Economic Landscape: What Investors Need To Know

March 08, 2025

Via Talk Markets

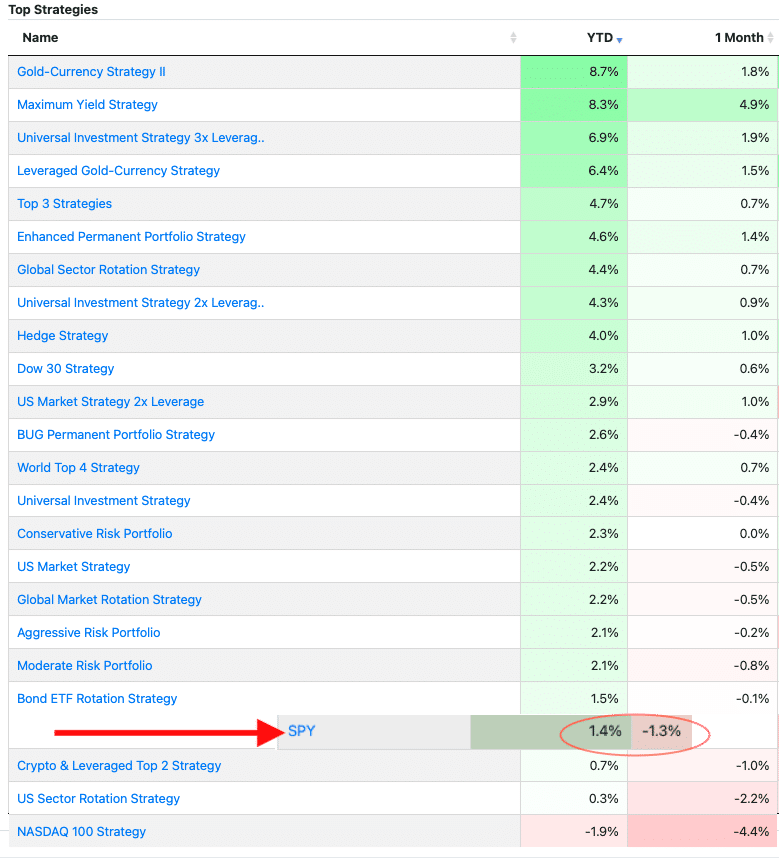

The Logical-Invest Newsletter For March 2025

March 04, 2025

Via Talk Markets

Something Wicked Is Coming - Here’s How To Get Ready

March 03, 2025

Via Talk Markets

Why 10-Year Yields Are Easing – And What It Means For Stocks

March 02, 2025

Via Talk Markets

Via Talk Markets

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.