iShares 20+ Year Treasury Bond ETF (NQ:TLT)

All News about iShares 20+ Year Treasury Bond ETF

The Short-Term Uptrends Hint At A Bear Market ↗

March 29, 2025

Via Talk Markets

Via Benzinga

Via Benzinga

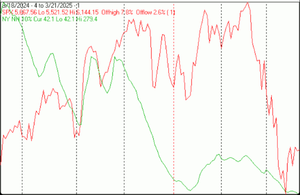

CoT: What Futures, Hedge Funds Positions Can Tell Us ↗

March 23, 2025

Via Talk Markets

Via Talk Markets

CoT: Peek Into Future Thru Futures, Hedge Fund Positioning ↗

March 09, 2025

Via Talk Markets

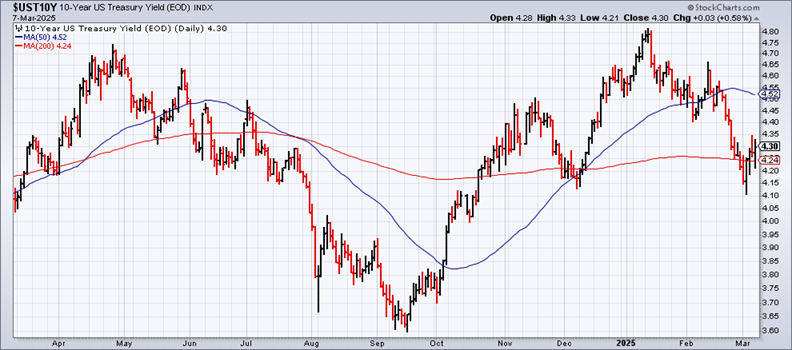

Trump’s Economic Landscape: What Investors Need To Know ↗

March 08, 2025

Via Talk Markets

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.