Watch Lone Star Video at: http://bit.ly/2VBdNRY

Vancouver, B.C. Canada – TheNewswire - July 29, 2021 - Belmont Resources Inc. (TSXV:BEA) (Frankfurt:L3L2) (“Belmont”), (or the “Company”) is pleased to announce that it has signed a definitive Share Purchase and Sale Agreement (the “Agreement”) with Advanced Mineral Technology Inc., a private Washington State corporation (the “Vendor”) that owns 100% of the issued and outstanding common shares of BGP Resources Inc. (“BGP” and the “BGP Shares”).

Belmont is acquiring the Lone Star Property through the acquisition of all outstanding shares of BGP Resources Ltd. which holds 100% interest in the Lone Star Property.

The 234 hectare Lone Star Property is comprised of a series of contiguous Washington State patented lode claims which covers the past producing Lone Star Mine.

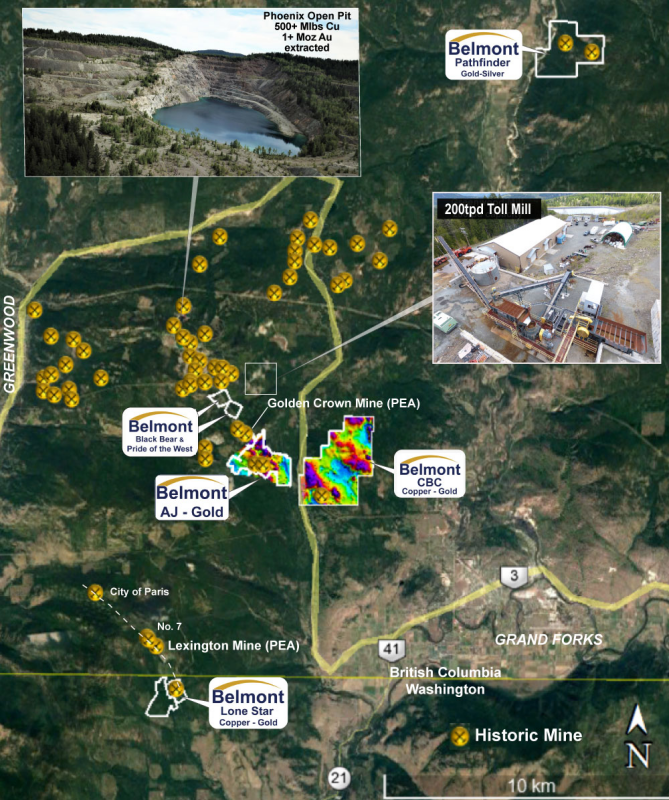

Belmont Properties Map

View Belmont Properties Map at: https://bit.ly/3zKH0L5

The Lone Star mine operated over two time periods; underground from 1897-1918 producing 146,540 tonnes, and open-pit from 1977-1978 by Granby Mining Co. when 400,000 tonnes of ore were transported from the Lone Star open pit to its Phoenix mill in B.C, 11km to the north.

The Lone Star deposit has an historic resource estimate which was reported in a “Technical Report and Resource Estimate on the Lone Star Deposit, Ferry County Washington (September 23, 2007)” for Merit Mining Corp. and authored by P&E Mining Consultants Inc.

X2007 Historic Resource Estimate @ 1.5% Cu Equivalent Cut-Off Grade | |||||||

Class | Tonnes | Au g/t | Cu% | CuEq% | AuEq g/t | AuEq oz | Cu Mlbs |

Indicated | 63,000 | 1.28 | 2.30 | 2.69 | 8.82 | 19,600 | 3.19 |

Inferred | 682,000 | 1.46 | 2.00 | 2.44 | 8.02 | 192,936 | 30.07 |

Lone Star Historic Resource

The 2007 historic resource estimation was based on US$593/oz gold and US$2.84/lb copper.

View Historic Resource Table at: https://bit.ly/378Xmkq

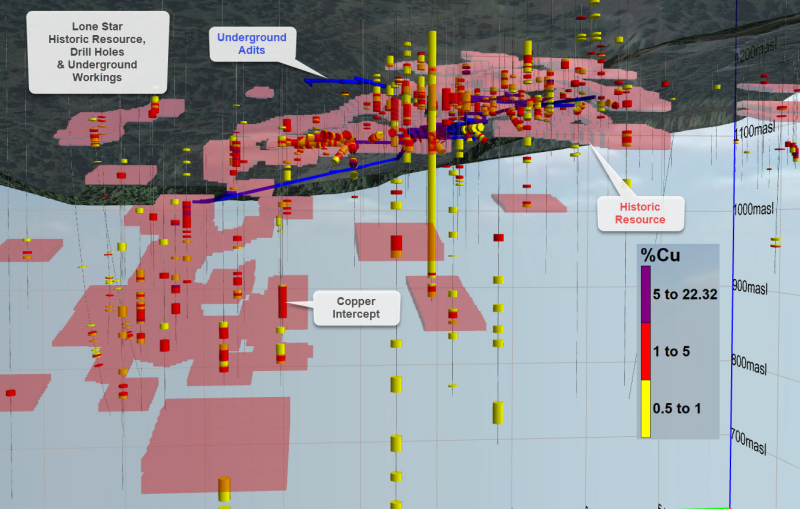

Based on higher copper prices, Belmont geologists have reconsidered the high-grade Cu +/- Au

drillhole intercepts in the area of the historic resource for the potential to support an underground

operation. Many historic Lone Star intercepts demonstrate underground mine widths and grade.

Some example drill intercepts are listed below.

XHole ID | From (m) | To (m) | Thickness (m) | Au g/t | Cu % | Cu%EQ |

IC-2 | 55.50 | 60.80 | 5.30 | NA | 5.80 | >5.80 |

IC-4 | 70.10 | 73.20 | 3.10 | NA | 16.25 | >16.25 |

IC-7 | 106.00 | 122.60 | 16.50 | NA | 3.71 | >3.71 |

IC-13 | 166.10 | 176.80 | 10.70 | NA | 3.73 | >3.73 |

L81-3 | 68.90 | 83.20 | 14.30 | 1.06 | 3.01 | 3.38 |

K-9 | 6.10 | 13.70 | 7.60 | 1.70 | 4.05 | 4.82 |

K-13 | 32.00 | 36.60 | 4.60 | 2.56 | 2.97 | 3.87 |

G-55 | 32.30 | 35.70 | 3.40 | 4.58 | 6.69 | 8.29 |

NA=not assayed for gold | ||||||

Historic Intercepts on the Lone Star Deposit

View Lone Star example drill intercepts at: https://bit.ly/3xbkYiX

Lone Star Historic Resource and Underground Workings

View Lone Star 3D Historic Resource Model at: https://bit.ly/2TEeWts

George Sookochoff, President & CEO commented “The acquisition of Lone Star property is directly in line with Belmont’s strategy to consolidate quality mineral assets in the Greenwood – Republic mining camps. Lone Star’s high grade copper values considerably strengthens our copper base and allows Belmont to leverage today’s record breaking copper prices.”

Terms of the Agreement:

In consideration and subject to TSX Venture Exchange (“Exchange”) approval of agreement,

- and 30 days upon signing this agreement during which time the Company will conduct a proper legal due diligence and independent verification of land title and tenure verifying the legality of any underlying agreement(s) that may exist concerning the licenses or other agreement(s) between any third party.

The Company will pay the Vendor:

- 500,000 Belmont shares issued subject to 4 months+1 day hold period from issuance date.

- An initial $25,000 US cash payment

- Upon first anniversary of agreement:

- An additional 500,000 Belmont shares issued for a total of 1,000,000 Belmont shares.

- An additional $75,000 US in cash for a total of $100,000 US.

NI 43-101 Disclosure:

Technical disclosure in this news release has been approved by Laurence Sookochoff, P.Eng., a Qualified Person as defined by National Instrument 43-101.

A qualified person has not done sufficient work to classify the historic estimate as current mineral resources or mineral reserves. As such the issuer, Belmont Resources, is not treating this historical estimate as current mineral resources or mineral reserves.

(1) Mineral resources which are not mineral reserves do not have demonstrated economic viability.

(2) Gold equivalent (AuEq) grade was calculated utilizing a gold price of US$593/oz and copper price of US$2.84/lb., based on the 24 month (at July 31, 2007) trailing average of gold and copper prices, to obtain a conversion factor of % copper x 3.284 + gold g/t = Au Eq g/t. Metallurgical recoveries and smelting/refining costs were not factored into the gold equivalent calculation.

About Belmont Resources

Belmont Resources is engaged in the business of acquiring and developing gold-copper-lithium projects located in North America. By utilizing new exploration technology and geological modelling the company is identifying new sources of gold-copper-lithium-uranium mineralization.

The Belmont project portfolio:

– Athelstan-Jackpot, B.C. – *Athelstan & Jackpot Gold mines

– Come By Chance, B.C. – *Betts Copper-Gold mine

– Kibby Basin, Nevada – Lithium

– Lone Star, Washington – *Copper-Gold mine

– Pathfinder, B.C. – *Bertha & Pathfinder Gold–Silver mines

* past producing mine

ON BEHALF OF THE BOARD OF DIRECTORS

“George Sookochoff”

George Sookochoff, CEO/President

Ph: 604-505-4061

Email: george@belmontresources.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as the term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Copyright (c) 2021 TheNewswire - All rights reserved.