Since January 2025, Northwest Bancshares has been in a holding pattern, floating around $12.61. The stock also fell short of the S&P 500’s 6.9% gain during that period.

Is now the time to buy Northwest Bancshares, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Do We Think Northwest Bancshares Will Underperform?

We don't have much confidence in Northwest Bancshares. Here are three reasons why you should be careful with NWBI and a stock we'd rather own.

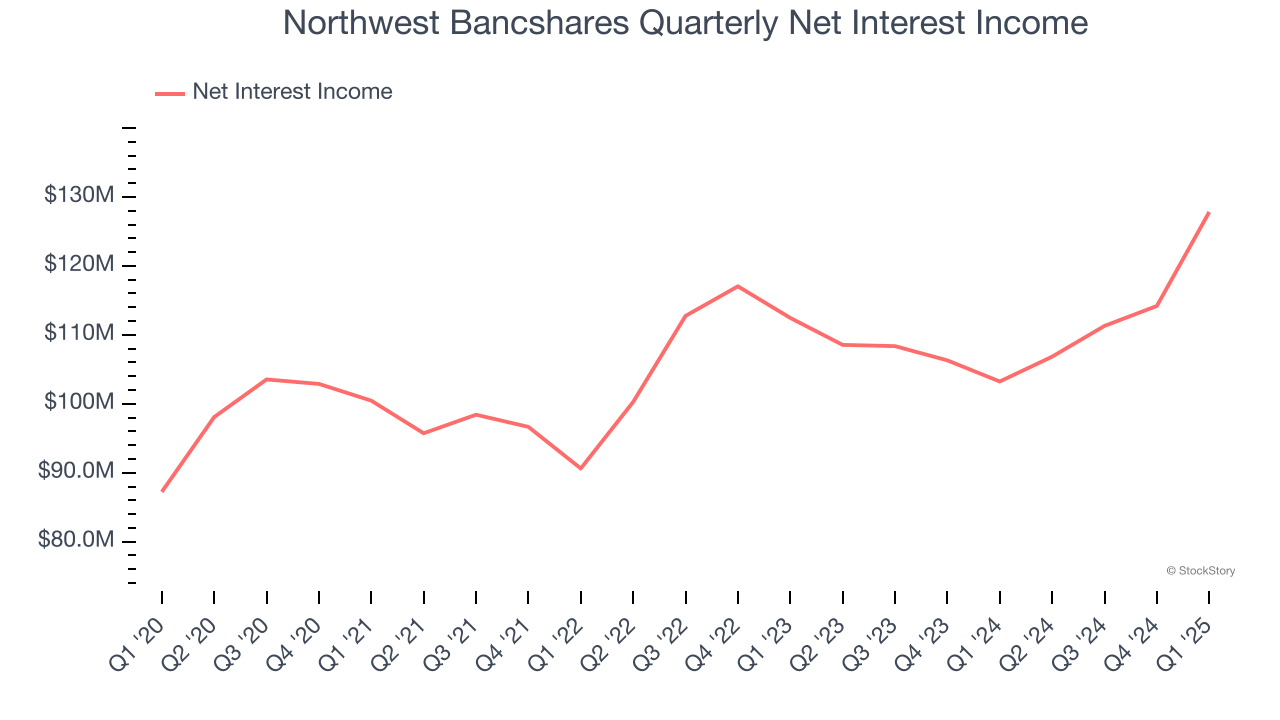

1. Net Interest Income Points to Soft Demand

While banks generate revenue from multiple sources, investors view net interest income as the cornerstone - its predictable, recurring characteristics stand in sharp contrast to the volatility of non-interest income.

Northwest Bancshares’s net interest income has grown at a 3.2% annualized rate over the last four years, worse than the broader bank industry. Its growth was driven by both an increase in its outstanding loans and net interest margin, which represents how much a bank earns in relation to its outstanding loan book.

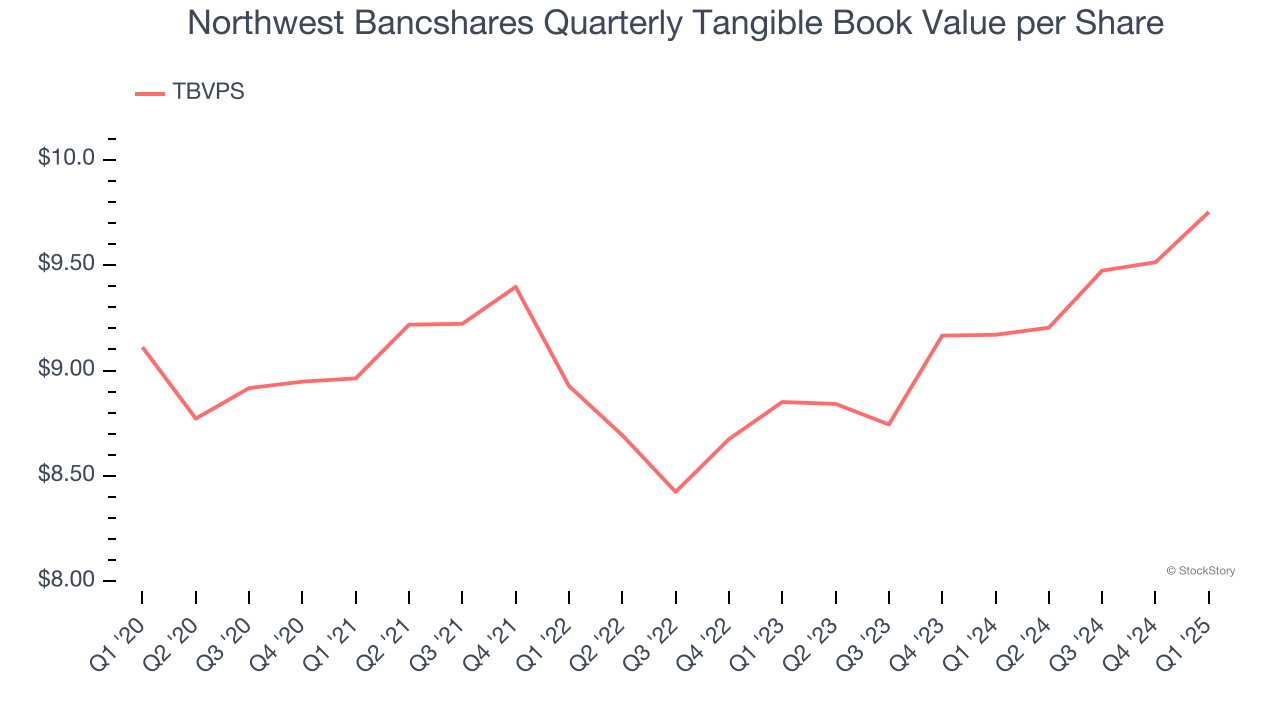

2. Substandard TBVPS Growth Indicates Limited Asset Expansion

In the banking industry, tangible book value per share (TBVPS) provides the clearest picture of shareholder value, as it focuses on concrete assets while excluding intangible items that may not hold value during challenging times.

To the detriment of investors, Northwest Bancshares’s TBVPS grew at a sluggish 5% annual clip over the last two years.

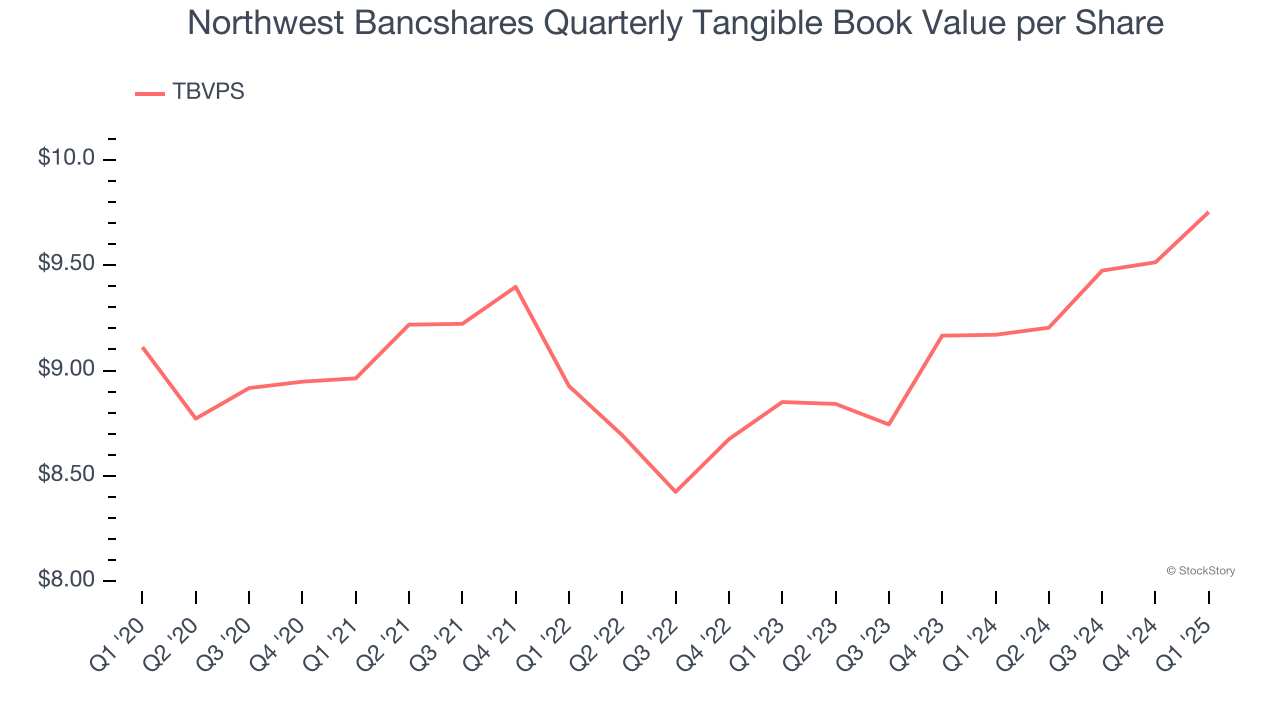

3. TBVPS Projections Show Stormy Skies Ahead

Tangible book value per share (TBVPS) growth is driven by a bank’s ability to earn more than its cost of capital through lending activities while maintaining a strong balance sheet.

Over the next 12 months, Consensus estimates call for Northwest Bancshares’s TBVPS to shrink by 7.1% to $9.06, a sour projection.

Final Judgment

We see the value of companies driving economic growth, but in the case of Northwest Bancshares, we’re out. With its shares underperforming the market lately, the stock trades at 1.1× forward P/B (or $12.61 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better opportunities elsewhere. We’d recommend looking at the most entrenched endpoint security platform on the market.

Stocks We Like More Than Northwest Bancshares

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.