iShares 1-3 Year Treasury Bond ETF (NQ:SHY)All News about iShares 1-3 Year Treasury Bond ETF

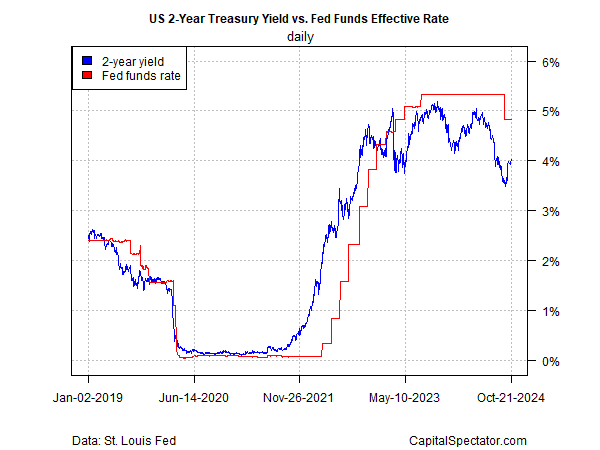

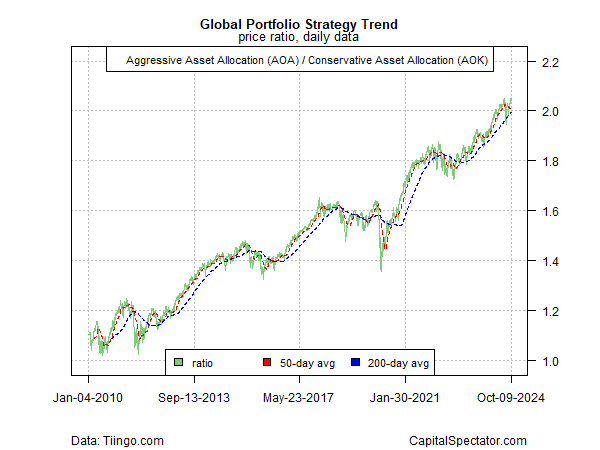

Markets Confident That Rate Cuts Will Start In September

July 15, 2024

Via Talk Markets

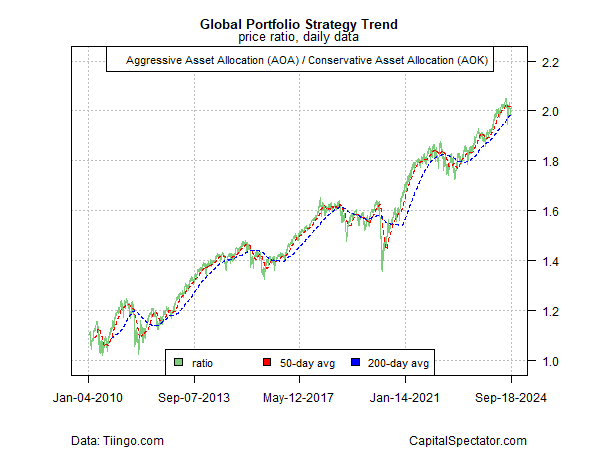

The Fed “Train” Is Leaving The Station: Destination Unknown

September 16, 2024

Via Talk Markets

Topics

Economy

Via Talk Markets

Topics

Economy

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the following Privacy Policy and Terms Of Service. |

|

iShares 1-3 Year Treasury Bond ETF (NQ:SHY)All News about iShares 1-3 Year Treasury Bond ETF

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the following Privacy Policy and Terms Of Service. |

|