iShares 1-3 Year Treasury Bond ETF (NQ:SHY)

82.81

-0.02

(-0.02%)

Streaming Delayed Price

Updated: 12:26 PM EST, Nov 17, 2025

Add to My Watchlist

All News about iShares 1-3 Year Treasury Bond ETF

Vigilare Reduces SHY Holding Amid Rate-Cut Uncertainty ↗

October 03, 2025

Via The Motley Fool

Loonie Going Loco… ↗

December 30, 2024

Via Talk Markets

Next SPX Move Will Surprise You ↗

April 20, 2025

Via Talk Markets

Via Talk Markets

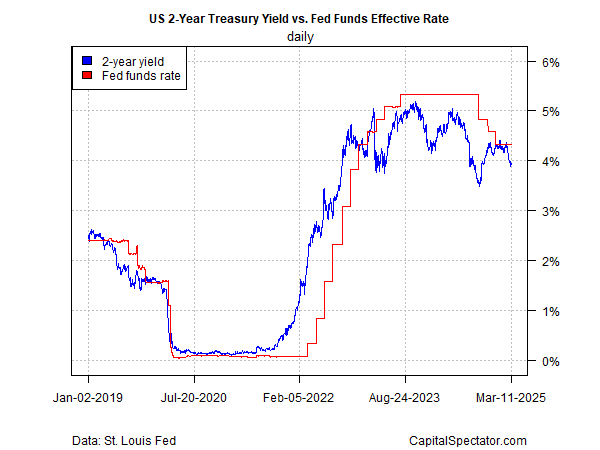

A Fed Rate Cut May Be Near, But Not Today ↗

March 19, 2025

Via Talk Markets

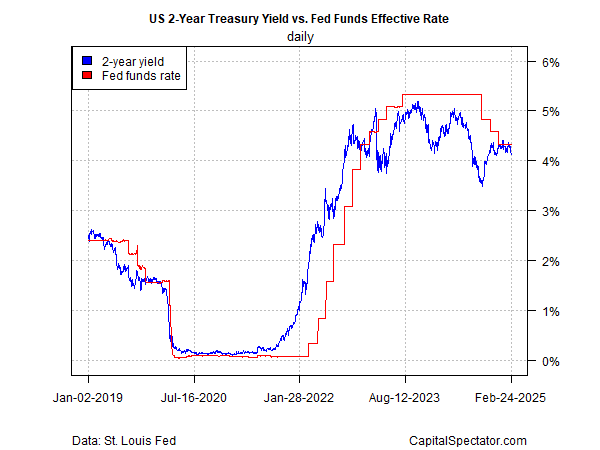

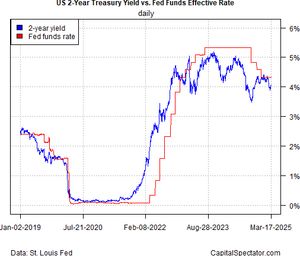

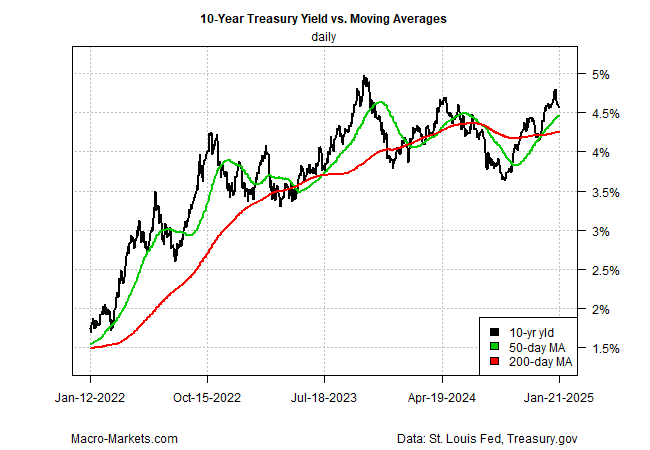

Treasury Market Pricing In Higher Odds For Rate Cuts ↗

March 12, 2025

Via Talk Markets

Via Talk Markets

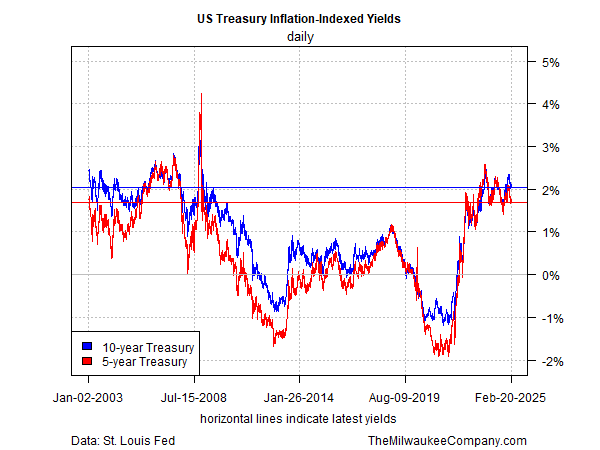

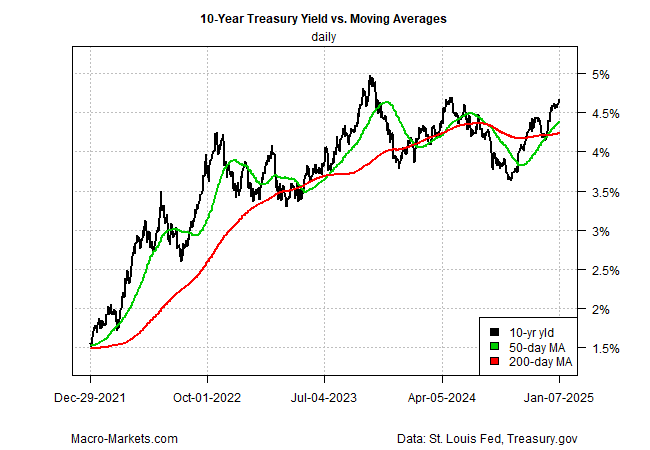

Real (Inflation-Adjusted) Treasury Yields Remain Elevated ↗

February 21, 2025

Via Talk Markets

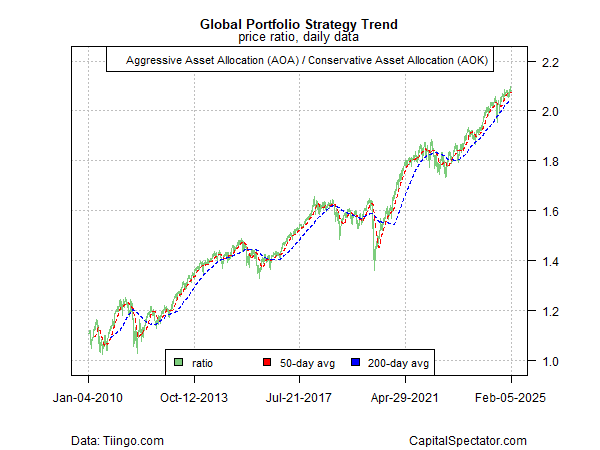

Risk-On Sentiment Endures, Despite Trade Uncertainty ↗

February 06, 2025

Via Talk Markets

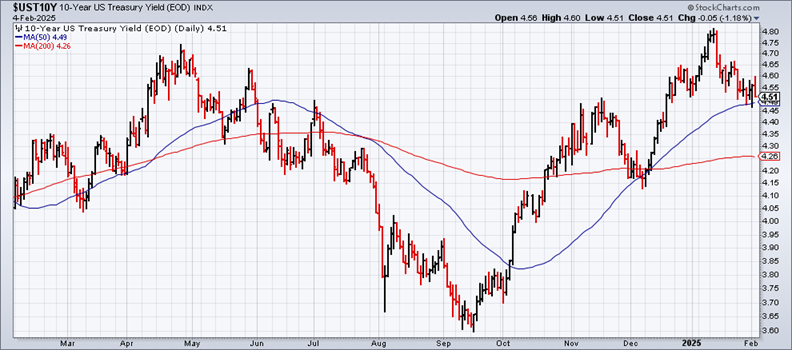

Weekly Market Pulse: Is The Honeymoon Over Already? ↗

January 27, 2025

Via Talk Markets

Via Talk Markets

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.